네트워크

(Network)

時間이 反映되지 않는 情報와 Network와 Infra와 Credit과 苦生는 無意味하다.

Infra

Solution & Service Based

Medical

Imaing Modality Distribution Network

Global

Medical Imaging Systems Manufacturer

GE www.GE.com www.ge.co.kr www.gehealthcare.com

Siemens www.siemens.com

Philips www.philips.com www.philips.co.kr www.medical.philips.com/iU22

DRKwon

(China CT & MR Market 70% - GE, Siemens, Philips)

NeuSoft

(North East University Software) www.neusoft.com 2012 CT FDA Approval, 2015 PET-CT

United

Imaing www.united-imaging.com CT, MRI, PET-CT, PET-MR, 방사선암치료기

2015. 1 ~ 2016. 5: 100 set distribution (DR 50 set

vs. CT, MRI, PET-CT 50 set)

2019년 기준: 중국 내 병원 3,200곳 & 6,400대 설치 & 전체 직원 2,900명 중 60% R&D 인력 1,700여명

16

채널 이하 CT: 중국 시장점유율 3위 (1위 씨멘스, 2위 GE)

1.5T

MRI: 중국 시장점유율 3위 (1위 GE, 2위 씨멘스)

PET-CT:

2017~2019 3년간 중국 도입 100대

중 50대 차지 (3년 시장점유율 1위)

Mindray www.mindray.com Zonare / R&D Center China 3 sites + USA 1 site

+ Sweden 1 site = 1,400 researchers.

Endoscopy (ES) launching

SonoScape 2nd US in China

2014 ES launching (HD500, HD330, HD320)

AOHUA www.aohua.com Endoscopy

Wandong

www.wandong.com.cn [China Resources Wandong Medical Equipment Co., Ltd

/ CR Wandong] China X-ray M/S 50%

Toshiba

Healthcare Company www.toshibamedicalsystems.com

Acquired

by Cannon 2018 -> Cannon Medical Systems (Toshiba US = Cannon US)

Subsidiary

Companies

Vital

Images

Olea

Medical

Hitachi

Medical Corporation www.hitachimedicalsystems.com Aloka US

Olympus www.olympus-global.com

Hoya www.hoya.com Pentax ES

Fuji Flim

www.fujifilm.com Fujinon ES

Carestream www.carestream.com Kodak Healthcare 인수

Agfa

Healthcare www.agfahealthcare.com

Konica

Minolta www.konicaminolta.com

ENVOY

AI www.envoyai.com

Healthcare

Exhibitions

CMEF www.cmef.com.cn China Internatioinal

Medical Equipment Fair

ITEM

Healthcare Solution

이지케어텍 www.ezcaretech.com

오토에버시스템즈 www.autoeversystems.com

X-EHR

Advanced

Solutions Specifically Designed for Healthcare

Merge

– An IBM Company www.merge.com Big Data Intelligence with Deep Learning

IT Total Solution & Service

KCC정보통신 www.kcc.co.kr 漢城自動車

다우기술 www.daou.com

Benchmarking

獨逸强小企業

Car Solution

한온시스템 www.hanonsystems.com

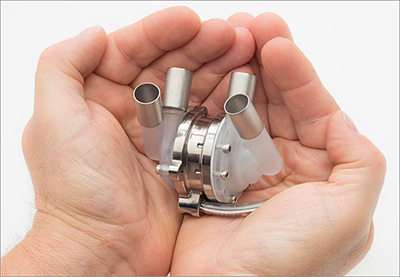

Artificial Heart

인공심장

전세계적으로 2,300만명이

심부전 환자이며 이중 10분의1은 말기 심부전 환자

(한국의 경우 2015년

기준 심부전 환자는 80만명)

<인구의 고령화에 따라 계속 늘어남>

미국 질병통제에방센터(CDC): 미국에서 33초마다 1명이 심혈관 질환으로

사망하며, 2021년 심장 질환으로 695,000명 사망 (Global 1/5 수준)

2017년 한국 심장이식 대기자 559명 vs. 심장이식자 184명

LVAD

1억 6,400만원 (2018년 정부 의료보험 급여 1억 5,500만원 + 환자 부담 830만원)

1967년 세계 최초의 타인의 자연심장이식에 성공한 이래

수십년간 흔히들 ‘말기 심부전’ 환자의 최상의 치료법은

타인의 자연 심장이식으로 알려져 있다.

전세계가 노령화되어 갈수록 전세계적으로 말기 심부전

환자도 급증할 터인데

타인의 자연 심장이식은 대기자와 공여자의 괴리와

이에 따른 기약없는 공여자 기다림의 정신적 고통과

공여자 찾아도 수술의 급박성을 고려하자면

<사회적 관점>에서는 타인의 자연 심장이식은 말기 심부전 환자의 근본적 해결책은 아니다.

또한 최신 연구결과에 의하면 자연 심장이식수술을 받은 환자는 5년

내에 11%가 사망률이 높은 악성암에 걸리는 것으로 보고된다.

원인은 심장이식수술을 받은 환자는 (타인 심장이식에 따른) 면역억제제의 복용에 따른 필연적 부작용이다.

Pacemaker,

Implantable Defibrillator, CID (Implantable Cardioverterdefibrillator) (제세동기, 인곰심장박동기) CT &

MRI Overcome

메드트로닉 (Medtronic) Evera

IABP

(Intra-Aortic Balloon Pump, 대동맥내 풍선 펌프)

대동맥 내에 가늘고 긴 풍선을 넣어서 심전도(ECG)에 동기시켜 좌심실 수축기에 오무라들게 하고 확장기에 팽창시킴.

ECMO (extra corporeal membrane oxygenation) Portable 방향

CPB (cardiopulmonary bypass) Portable

방향

ECLS (extra corporeal life support) Portable

방향

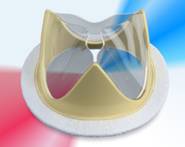

Prosthetic Cardiac Valve (인공 심장 판막)

Global 시장 규모: 2024년 USD 133억불

시장 전망: 2033년까지 USD 359억불 예상 (연평균 성장률 CAGR 11.62%)

전세계 인공 심장 판막 시술

(Azari, S. et al. “A systematic review …,” Heart Fail. Rev. 2020, 25, 495~503.)

: Approximately 250,000 ~

300,000.

Tissue Valve (생체 인공판막,

돼지, 소, 또는 사람 근막): 항응고제 필요없으며 소음이 없으나 내구성(10~15년)이

약하며, 경우에 따라서는 세균 감염

항응고제 처방을 해서는 안되는 환자에게 적용.

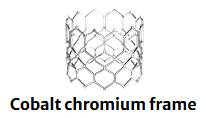

Mechanical Valve

(기계식 인공판막): 반영구적 but 소음문제 & 항응고제, 200 ~ 300만원대

Edwards Lifesciences Corp (Caged Ball Valve, 높은 수준의

항응고 필요) 1958년 창업

1960년 8월 25일

처음으로 이식 <세계 최초>

2007년 단종

지금은 사패엔 3 울트라로 불리우는 심장 밸브에 주력

중

Sapien 3 Ultra

Valve, (www.edwards.com)

Bjork-Shiley (Tilting

Disk Valve)

전세계적으로 가장 많이 사용

한편에서는 장기 사용에서 파편 문제와 균열 문제로

환자 집단 소송이 끊이지 않음.

특허 만료

St. Jude (Bileaflet

Disk Valve)

혈류 역학적으로 가장 우수 평가

2017년

Abbott로 매각

특허 만료

Medtronic (Hall

tilting Disc Valve)

특허 만료

CoreValve Evolut ™ System (www.medtronic.com)

Conventional

Polymer Cardiac Valve (기존 고분자 판막)

기존 폴리우레탄 고분자 판막: 일시적 사용의 혈액 펌프용

기존 폴리우레탄 고분자 판막 문제점: 혈전 합병증 (thrombotic complications), 석회화 (calcification), 판누스 형성 (Pannus Formation)

Novel

Polymer Cardiac Valve (혁신 고분자 판막) – Foldax www.foldax.com

동물 실험 결과 (animal experiment): no thrombosis or calcification on leaflet

surfaces

임상 시험

(clinical trial): 미국 FDA

임상 적용: 인도의 8곳 센터에서 임상 적용 중

TRIA ™ Mitral Valves (www.foldax.com)

판막성형술

(Carvar et al.)

성형술로만 치료가 가능하다면 최선의 방안이나

…

VAD (Ventricular Assist Device) 3L/min (vs. 100 mmGh) From Puming type

to Axial or Centrifugal

type

자빅하트 (Javikheart) Jarvik 2000

https://www.jarvikheart.com/about-us/robert-jarvik-md/

메드트로닉 (Medtronic) HVAD

https://www.medtronic.com/us-en/patients/treatments-therapies/ventricular-assist-device.html

에보트 (Abbott laboratories) 자회사 소라텍 (Thoratec) HeartMate

I, HeartMate II, HeartMate III

2017

St. Jude 인수인계

TAH (Total Artificial Heart) 완전임공심장에서 자연심장이식 대기 기간 사용 또는 BVAD 방향

Abiomed

(U.S.A)

AbioCor www.abiomed.com 혈전(thrombus) 형성 등의 결정적 문제가 해결되지 않아 2016년 개발 중단

이후 Impella Heart Pump에 집중

2022.

11. Johnson & Johnson(J&J)에 현금 166억불에 매각.

Carmat

(France) www.carmatsa.com/en

Bivacor

(U.S.A) www.bivacor.com 2008 ~ 현재 계속 임상 실험 중이며 심장이식 대기용으로는 성공적 임상 결과

소재: 티타늄 (Titanium)

특징

- 밸브와 베어링이 없음

- Floating Rotor (부유 로터):

자기력을 이용해 공중에 떠서 혈액을 순환하는 방식 (정체 구간 감소로 혈전 생성 가능성

감소)

- 마찰 최소화:

내구성 향상

Source (출처): Bivacor homepage (www.bivacor.com)

심장병 환자를 위한 (타인 심장 이식 이외의) 인공심장 연구로는 현재

(1) (심장 근육) 유도만능 줄기세포 (iPS 세포) vs. (2) 이종간 심장 이식 (미니 무균

돼지 심장, …) vs. (3) 기계식 인공심장

이렇게 크게 3가지 분야로 연구 중이며 각자 장단점이

명확하다.

(심장 근육) 유도만능 줄기세포로 심장 패치를 제작하여 환자 심장에 붙여서 심장 기능을 회복시키는 연구가 임상적으로 최근

성공하였으며,

이종간 심장 이식은 면역 거부 반응 문제를 지속적으로 해결하고 있으며, 심장 뿐 아니라 간, 신장 등

다른 장기로도 성공적으로 확대 중이다.

기계식 완전 인공심장은 자연심장 이식 대기용으로 입지를 다지고

있으며, 양심실 보조 장치는 시장에 성공적으로 안착하였다.

미국 Cleveland Clinic의

P-CFTAH, Source (출처): Cleveland Clinic

(과거) 일본 동경대의 Undulation Pump TAH와 기본 원리가 유사

대동맥판막역류: 대동맥 판막의 기능 장애로

인하여 혈액이 심장으로 역류하는 질환. 심장은 부족한 혈액을 보충하기 위하여 더 많은 일을 하게 되고

이는 심장의 부담으로 작용.

협심증 (angina pectoris): 심장에

공급되는 혈관이 여러 원인(동맥경화증, 혈전, 경련수축 등)에 의하여 좁아져서 혈액 공급이 충분치 못한 (허혈) 증상

심근경색 (Myocardial

infarction): 좁아진 혈관에 혈전으로 막혀 혈액 공급이 중단되 심장 근육이 손상되는 질환

부정맥: 심장이 동방결절의 전기 자극에

의해 뛰는 것이 아닌 비정상 상태

심부전증: 심장 기능이 떨어진 (pumping 기능이 떨어진) 상태

TAVI (Transcatheter

Aortic Valve Implantation) 대동맥판막 삽입술

Mobility Stability

[Car]

Peugeot Suspension - Cornering & Handling

[Ship]

Tank-Less System

[Airplane]

Bird Strike

경수제철 www.kyungsoo.co.kr Parking

B/D (주차 전문 빌딩)

Camper &

Nicholsons International https://camperandnicholsons.com

Yacht

Digital

Modality Distribution

윈도우 XP 출시:

2001년 10월 25일 (최장 수명 OS) / 윈도우 XP

연장 지원 중단: 2014년 4월 8일

윈도우 Vista 출시: 기업용 2006년 11월 30일 vs. 개인용 2007년 1월 30일

윈도우 7 출시:

2009년 / 윈도우 7 일반 지원 중지: 2015년 1월 12일 / 윈도우 7 연장 공식 지원 중단:

2020년 1월 14일 / 2023년까지는 기업에 한정 유료로 지원

Home Basic

Home Premium

Professional

Enterprise

Ultimate

윈도우 8: 2012년 19월 26일

출시되어 (일반 지원 날짜는 2023년이나 Windows 8.1 나온 이후) 2016년 1월 12일 기술 지원 종료란 매우 짧은 수명의 흑역사 제품

윈도우 8

(8.1) 출시: 2012년 10월 28일 / 윈도우 8 연장

공식 지원 중단: 2023년 1월 10일

Core

Pro

Enterprise

UEFI booting (윈도우 8부터 적용)

EFI로 설정돼

있는 파티션을 자동으로 찾아 특정 경로에 위치한 부트 로더로 부팅하는 방법.

윈도우 8부터 적용된 관계로 UEFI 모드로 변경을 해야 윈도8 설치가 가능.

최근 나온 메인보드의 UEFI 펌웨어들은 대부분

CSM (Compatibility

Support Module)이라고 해서, BIOS booting (legacy BIOS)과 UEFI booting 모두

지원함.

하위 버전인 윈도7을 사용하기 위해서는 CSM으로 설정해야 정상적인 OS설치가 가능함.

윈도우 10 출시:

2015년 7월 29일 / 2023년 1월 31일

판매 종료 / 2025년 10월 14일 서비스 종료 예정

Home

Pro

Enterprise

윈도우 11 출시:

2021년 10월 05일

21H2:

2024년 10월말 서비스 종료

22H2

23H2

24H2:

2024년 10월말 출시 예정

MS

SQL Server 2012: 2022년 7월 12일

연장 지원 종료

OS

Win10까지

지원 (OS Win11 지원 X)

Win

Svr 2019까지 지원

MS SQL Server 2014

OS

Win10까지 지원

Win

Svr 2019까지 지원

MS

SQL Server 2016: 2026년 7월 14일

연장 지원 종료

OS

Win10까지

지원 (OS Win11 지원 X)

Win

Svr 2019까지 지원

MS SQL Server 2017

MS SQL Server 2019

Windows Server

2008 & 2008 R2: 2020년 1월 14일로 기술 지원 종료

Windows Server

2012 & 2012 R2: 2023년 10월 10일로 기술 연장 지원 종료, 최초의 클라우드 운영 체제

Windows Server

2016: 2027년 1월 12일 연장 지원 종료

Windows Server

2019

Windows Server Essentials 2019: Under 25 Users or 50 Devices

Windows Server

2022

<코드 네임>

1.

Nehalem

(네할렘)

2008년

린필드 -> 블룸필드 -> 클락데일 -> 걸프타운

2.

Sandy

Bridge (샌디브릿지)

3.

Ivy

Bridge (아이비브릿지)

4.

Haswell

(하스웰)

5.

Broadwell

(브로드웰)

i5 / i7만 존재

4세대와 6세대간의 시간적 공백을 메우는 버림받은

세대

6.

Skylake

(스카이레이크)

DDR4

4K monitor support

<2 ~ 6세대 공통>

셀러론: Dual Core 2 Thread / L3 2MB

/ Turbo Booster 없음

펜티엄: Dual Core 2 Thread / L3 3MB

/ Turbo Booster 없음 / 등급별로 내장메모리 콘트롤러 상승

i3: Dual Core 4 Thread / L3 3MB / Turbo

Booster

i5: Quad Core 4 Thread / L3 6MB / Turbo

Booster / 완전한 Quad Core

i7: Quad Core 8 Thread / L3 8MB / Turbo

Booster / 논리 코어 적용

<노트북의

경우>

셀러론: 상동

펜티론: 상동

i3: Dual Core 4 Thread / L3 3MB / Turbo Booster 없음

i5: Dual Core 4 Thread / L3 3MB / Turbo

Booster / 노트북에서 가장 최적의 CPU

i7: Dual Core 4 Thread / L3 4MB / Turbo

Booster

i7q: Quad Core 8 Thread / L3 6MB / Turbo

Booster

<HDD>

2024. 10. WD 26TB CMR & 32TB Ultra SMR HDD

발표

국내 데이터센터 시장 규모 (자료: 한국 IT 서비스

산업 협회)

IT 서비스 기업 19개사

& IDC 기업 9개사 & 정부 및 지자체 8개 기관이 73개

data center를 운영 중 (2010)

|

연도 |

시장 규모 |

|

2005 |

3,570 억원 |

|

2006 |

4,162 억원 |

|

2007 |

5,560 억원 |

|

2008 |

7,850 억원 |

|

2009 |

9,100 억원 |

|

2010 |

9,828 억원 (예상) |

|

2011 |

1조원 이상 (예상) |

IT Exhibitions

Comdex www.comdex.com 세계 최대 규모의 IT 전시회

Comdex 차이나 www.comdex.com.cn

CES www.cesweb.org 매년 초 미국 라스베가스 개최 세계

최대 가전 박람회

Cebit (독일 하노버) 세계 규모의 IT 전시회

코엑스 www.coex.co.kr

IfSEC (유럽 최대 보안 전시회)

협회

정보보호산업지원센터 www.kisis.or.kr 얼굴인식 DB

음성정보기술산업지원센터 www.sitec.or.kr 음성

DB 공급

한국정보보호진흥원 www.kisa.or.kr

한국정보보호교육센터 www.certcc.or.kr

Robotics

Honda www.world.honda.com Asimo &

Intelligent Car

SONY Aibo 3년간

2,000억원 매출 (200만원)

AI

(Artificial Intelligence) & Big Data

MIT 미디어랩 www.media.mit.edu

MIT AI

랩 www.ai.mit.edu

Data

War & Finance Support

London

(Rothschild) / New York (Rockefeller,

Hilton)

Tokyo

(Mitsubishi) / Shanghai (安邦保險)

& Hong Kong (Truestand)

Seoul

(Myongdong, Yeouido)

자산 (Assets) = 자본 (Equity)

+ 부채 (Liabilities)

= 자본금 + 잉여금 + 부채

= 자본금 + 자본잉여금 + 이익잉여금 + 부채

총자산 = 자기자본 + 타인자본 = 자기자본 + 부채

자기자본 = 총자산 – 부채

자기자본 = 자본금 + 자본잉여금 + 이익잉여금 + 자본조정

(capital adjustment)

자본금 = 총발행주식수 + 액면가

자본잉여금 무상증자 배당은 비과세

이익잉여금은 ‘임의’준비금으로 (자본전입의 대상이 아니므로) 무상증자에는 사용할 수 없으나 주주배당은 가능

자본전입은 법정준비금에 한하고, 임의준비금은

자본전입할 수 없기 때문

임의준비금은 주주에게 배당할 이익인데, 이를

자본에 전입하여 배당할 수 없는 자본으로 고정화시에는 주주 이익배당청구권을 해치기 때문

이익잉여금을 이익준비금으로 항목 변경 처분하는 것은 매결산기의 정기주총에서 재무제표

승인절차를 거치는 것이 원칙이며,

임시주총 결의로 이익잉여금을 이익준비금으로 항목 변경하는 결의와 동시에 자본전입하는

결의를 함으로써 결국 임의준비금의 자본전입하는 예는 편법

매결산기 재무제표 승인시에 처분전이익을 관행적으로 이익잉여금으로 잡을 것이 아니라

자본금의 2분의 1에 해당할 때까지는 이익준비금으로 설정하는 것이 추후 무상증자 등에 대비할 수 있음.

이익준비금의 사용은 자본의 결손전보 또는 자본전입에만 한정되므로 주주에게 배당할

재원으로 활용하지 못함. (-> 그러나 준비금 감액 방법이 있음)

이익준비금(준비금): 영업거래로부터

발생하는 이익을 재원으로 적립하는 법정준비금 (상법: 자본의 2분의 1에 달할 때까지 이익준비금으로 적립토록 규정)

준비금의 총액이 자본금의 1.5배를 초과할

경우 주주총회 결의에 따라 이익잉여금으로 전환이 가능

준비금은 ‘법정’준비금이므로 무상증자나 자본결손에 따른 전보로 충당이 가능하나 주주배당에는

사용할 수 없음

준비금 감액에 따른 (이익준비금으로부터

전환된 이익잉여금) 배당은 비과세 -> 준비금의

이익잉여금 전환은 통상 주주배당을 위한 사전 작업이 경우가 많음

사내유보금 = 자본잉여금 + 이익잉여금. (그러나 재무재표상 사내유보금이란 항목은 없고 자본잉여금과 이익잉여금이란 두항목이 존재함.)

자본잉여금: 주식 발행시 액면가 이상으로

거래되어 생긴 차액

이익잉여금: 현금 뿐만이 아니라 기계설비, 공장, 토지, 연구개발

등에 사용된 금액도 포함됨.

종속회사: 보유지분 50% 초과하거나

50% 이하라도 실질적인 지배력이 있는 회사

관계회사: 직간접적으로 지분을 20% 이상

소유하고 있는 회사

연결재무제표 (consoliated financial sheets): 종속회사의

매출과 이익을 모회사 실적에 100% 반영하고, 관계회사는

지분법에 따라 반영.

결합재무제표 (combined financial sheets): 재벌(기업집단) 소속 모든 계열사의 개별재무제표에서 내부거래를 상계해 수평적으로

결합한 재무제표

- 현재 시행 중인 연결재무제표는 지분 30% 이상

기업만 작성토록 되어 있어서 파악이 불충분하여 정부는 기업구조개혁의 일환으로 도입

별도재무제표 (separate financial statement): 종속회사와

관계회사의 실적을 모회사 실적에 반영하지 않고, 투자한 주식에 대해서는 취득 원가로 반영하고 배당을

있을 경우에만 수익으로 인식.

개별재무제표 (separate financial statement): 종속회사가

없는 기업들에 해당하며, 관계회사가 있을 경우에는 지분법에 따라 반영.

EB (Exchangeable Bonds, 교환사채): 발행회사가 보유한 (자사주 포함) 상장 주식과 교환할 수 있는 회사채 (교환 대상 유가증권은 상장유가증권으로 제한하고 있으며 증권예탁원에 예탁 의무화)

CB (Convertible Bond, 전환사채): 회사채로서 BW와 다른 점은 전환 당시 주가에 따라 주식전환 가격이 다름. 발행사

입장에서는 채권 부채가 소멸되는 장점.

BW (Bond with Warrant, 신주인수권부채권): 회사채로서 CB와 다른점은 (1) 약정된 가격으로 (2) 신주를 발행하여 주식으로 전환할 수 있는 option (warrant)가

있음.

발생사 입장에서는 채권 부채가 남아 있고, 단지

신주 발행에 의하여 자본금만 늘어남.

보통주: 주권의 권리 행사가 있는 보통 주식

우선주: 이익배당과 잔여재산의 분배에서 보통주에 우선하는 주식

후배주: 이익배당과 잔여재산의 분배에서 보통주보다 열후한 주식

혼합주: 이익배당이나 잔여재산 분배에서 어떤 점에서는 보통주보다 우선하나 다른

점에서는 열후한 주식

상환주: 자금조달을 목적으로 발행한 주식으로서 이익배당에 우선하는 주식이지만

추후 이익으로 소각할 수 있는 주식

전환주: (우선주에서 보통주로 또는 후배주에서 보통주로와 같은) 회사에 전환을 요구할 수 있는 주식

l 보통주를 제외한 다른 주식들은 특수 목적을 위한 주식이므로 주권의 권리 행사가 없는

주식임.

l 추후 정해진 권리이행이 이루어지지 않는다면 주주총회에서 그 권리를 주장할 수 있음.

고정배당우선주: 우선주와 달리 정해진 가격으로 발행되고, 배당률도 고정되어 있어서 분기별 등과 같은 정해진 배당일에 같은 액수의 배당금을 지급. 일정 기간 이후 회사에서 이를 다시 회수하는 콜데이(Call Day)가

정해져 있음. 콜데이 이후에는 주가에 무관하게 회사에서 무조건 다시 발행가로 매입할 수 있는 권리를

행사할 수 있으므로 주가는 발행가 이하로 내려가는 경우는 거의 없음. (대표적: 제이피모건체이스 고정배당우선주)

Call Option (콜옵션): 특정한 기초자산을 만기일이나

만기일 이전에 미리 정한 행사 가격으로 살 수 있는 권리.

Put Option (풋옵션): 특정한 기초자산을 장래의 특정

기일에 미리 정한 가격으로 팔 수 있는 권리.

Short Positon (숏 포지션): 주식이나 통화 또는 선물이나

옵션 등을 매도한 상태, 또는 매도한 수량이 매수한 수량을 초과한 상태.

어떠한 금융 상품이 하락할 것으로 예상될 때 사는 것 (공매도)

해당 금융 상품이 하락하면 수익이 발생하고, 상승하면

손실 발생

일반적으로 종목의 하락은 빠르고 짧게 감.

Long Posion (롱 포지션): 주식이나 통화 또는 선물이나

옵션 등을 매수한 상태, 또는 매수한 수량이 매도한 수량을 초과한 상태.

어떠한 금융 상품이 상승할 것으로 예상될 때 사는 것 (공매수)

해당 금융 상품이 상승하면 수익이 발생하고, 하락하면

손실 발생

일반적으로 종목의 상승은 천천히 길게 감.

우선매수권 (call option): 다른 주주의 지분 매각시 먼저 매수할 수

있는 권리

동반매도권 (tag along): 다른 주주의 지분 매각시 함께 팔 수 있는

권리

(통상 1대 주주가 매각시 2, 3대 주주가 1대 주주와 동일한 가격으로 팔아달라고 1대 주주에게 요구할 수 있는 권리)

Mutual Fund (뮤추얼펀드): 유가증권 투자를 목적으로

설립된 법인회사

다수의 일반인 투자자를 모집하여 주식발행으로 거대 자금을 형성하여, 모집된 투자자산을 전문적 자산운용회사에 맡겨서 운용 수익을 투자자에게 배당금의 형태로 되돌려 주는 투자 회사

투자자들은 해당 뮤추얼펀드가 발행한 보통주 주식을 매입하는 것임.

자금 보관: 자산보관회사

자금 운용: 자산운용회사

일반 운용: 사무수탁회사

Hedge Funde (헤지펀드): 소수의 투자자들을 비공개로

모집하여, 매우 높은 차입비중으로 주로 위험성이 높은 파생금융상품에 공격적 투자를 하여 절대 수익 추구.

통상 수수료 체계> 매년 자산의 2%를 운용수수료로 하며 이익의 20%를 성과보수료로 차감

한 번에 움직이는 금액이 엄청나서 거대 헤지펀드 하나가 한 국가의 경제를 흔들 정도로

성장.

대표적1> 조지 소로스의 퀀텀펀드 (vs. 상대의 외환 보유액과의 전쟁) -> 2011년 소로스 펀드 매니지먼트

1992년 영국 파운드화 공격하여 영란은행 굴복 및 조지 소로즈 10억 달러 (1조원) 수익

https://blog.naver.com/nsgogo3/221772709299

1997년 태국 바트화 대량 공매도 (환투기: 외화 차액 수익) -> 아시아 금융 위기 여파 -> 1998년 한국 IMF

2011년 퀀텀 펀드 청산 후, 소로스 펀드 매니지먼트(Soros Fund Management)라는 family office 형태로

소로스 가문의 자금만을 운용

주식 시장, 외환, 벤처 캐피탈 등 전방위적인 투자

2016년 1월 중국 위안화 공격 (위안화 약세에 배팅) https://blog.naver.com/ipodkkk1/221726980896

당시 중국은 세계 제1의 4조

달러 외환 보유고에서 1조 달러를 내다 팔아서 방어에 성공하고 조지 소로스 막대한

손해

2016년 브렉싵 과정에서 독일 최대 은행 도이체방크 주식에 대해 약 700만주 숏 포지션 (공매도) 설정 (도이체방크 전체 주식의 0.51% 규모, 1조 유로 해당)

브렉시트 결정되면 영국 파운드화 폭락 예측이 적중

& 1992년과는 달리 투자 대상을 파운드화가 아닌 도이체방크 주식을 투자 대상으로 설정

2018년 1분기 61억 달러 자산 운용 중

2021년 소로스의 Net Worth (순재산): 86억 달러 (10조 1,471억원)

대표적2> 롱텀캐피탈매니지먼트 (vs. 따라쟁이들과 보유 채권의 디폴트 선언 등의 돌발변수와의 전쟁)

1993년 노벨경제학상 수상자들이 설립

1998년 러시아의 모라토리움(채무불이행) 선언으로 러시아 국채를 다량으로 보유한 롱텅캐피탈매니즈먼트 파산

자산규모 2조 미만: 주총에서 (상근감사 1명 이상의) 1~3명의 (상근) 감사 선임 <주총

특수관계자 합산 3% Rule 적용>

자산규모 2조 이상: (선임된 이사회

구성원 중 감사위원이 꾸려지는 [사내이사 감사위원의]) 감사위윈회

의무 설치 <주총 특수관계자 개별 3% Rule 적용>

인적분할: 분할을 통해 새로 생기게 되는 기업(신설법인)의 주식을 기존 주주들에게 배분

상장기업의 경우에는 신설법인도 일정조건 갖추면 상장기업이 됨

비상장기업이 상장기업과 합병한 후 다시 인적분할하면 인수기업과 피인수기업 모두 일정조건

갖추면 상장기업 지위 유지됨.

물적분할: 분할을 통해 새로 생기게 되는 기업(신설법인)의 주식을 기존 법인이 100% 보유하여 자회사화

신설법인의 경우는 주식분산기준 미충족으로 비상장기업이 됨

인물적분할: 인적분할과 물적분할을 결합

한 회사를 각 사업부문별로 여러 개로 분할하여 지주회사 구조화 (ex. 일동제약)

SPAC (Special Purpose Acquisition Company, 기업인수목적회사, 2009년 도입): 우량 장외기업의 합법적 우회 상장을 지원하기 위해 도입된 기업인수목적회사

- 비상장기업의 인수합병을 목적으로 하는 명목상 회사

(Paper Company)

- 미국 & 유럽 등 선진 해외시장에서

활성화된 시장으로 한국에서는 2009년 12월 자본시장법

시행령이 개정되면서 도입됨.

- 다수의 개인투자금을 모아서 상장한 후에 3년

내로 비상장기업을 합병해야 함.

- 합병에 실패하면 투자한 주주들에게 원금에 3년치

이자를 더해 지급한 뒤 해산하게 됨 (상장폐지 시 공모가와 소정의 이자를 돌려 받음, 2020년 기준 1.5% 이자)

- 즉, 공모가 밑으로 주가가 잘 떨어지지

않는 속성이 있으며, 우량 비상장사와 합병시에는 주가가 오를 확률이 큼.

- 반면 비우량회사(재무상태나 사업 내용

부실)와 합병이라고 판단시에는 장내 매도나 주식매수청구권 행사로 주식을 처분하면 됨.

- SPAC은 투자금의 90% 이상을 합병 기업을

찾을 때까지 한국증권금융에 에치해 둠. (스펙 예치 금리는 1년

단위로 조정되며, 2020년 기준 1.5% 이자 보장)

- 비상장기업 입장에서는 지정감사를 받지 않는 만큼 기업공개(IPO)에 비해 1년 6개월 ~ 2년 가량 빨리 상장됨.

- 자본시장법 기업가치는 자산가치 대 (미래)수익가치 = 1 대 1.5로 고정

- 그러나 SPAC 합병시 자본시장법의 기업가치에

특례 규정: 성장성 높은 장외기업을 합병하기 위한 취지로 (미래)수익가치 산정을 자율에 맞김

- 2015년부터 2020년 SPAC 승인받은 51개사 중 45개

기업이 합병 당시 제시한 수익 전망치에 못 미침.

- 디알텍, RFHIC, 네오셈, 한송네오텍, 써노텍, 켐온, 포인트엔지니어링, 에치에프알, 퓨쳐스트림네트웍스, 예선테크, ….

- 합병시 부실 합병 방지 요건을 둠

코스닥의 경우 합병 대상 기업의 이익 규모는 계속사업이익이 있어야 하며, 매출액 100억원(벤처 50억원) 이상이어야 함

기업가치가 예치금의 80% 이상이어야

함

설립인과 이해관계가 없어야 함

LP (Limited Partner): Ownership of

Fund/Investment, 자금만 대는 투자자 <국민연금>

GP (General Partner): Management of

Fund/Investment, 투자에 적극적으로

개입하고 운용하는 투자자 <싱가폴 테마섹>

KOSPI

vs. KOSDAQ 일반

vs. KOSDAQ 벤처

vs. KOSDAQ 성장형 벤처 vs. KONEX

한국거래소 www.krx.co.kr

KOSPI 시장 상장 요건 [Steady Big Sales ->

Front Door]

(30

Billion Wons Capital Increase without consideration)

자기 자본 300억 이상

경영 성과 요건 택 1 (이익 규모, 매출액, 기준 시가 총액 중 택일)

매출액 및 이익 등

최근 매출액 1,000억원 이상 & 3년 평균 700억원 이상 (?)

이익은 다음 중 하나 충족

최근 ROE 5% 이상 & 3년 합계 10% 이상

이익액 최근 30억원 & 3년 합계 60억원 이상

자기자본 1,000억원 이상 법인: 최근 ROE 3% 또는 이익액

50억원 이상이고 영업현금흐름이 양(+)일 것

매출액 및 기준 시가 총액

기준 시가 총액 및 이익액

기준 시가 총액 및 자기 자본

KOSDAQ 시장 등록 요건 [Steady Big Profit ->

Back Door]C

(3

Billion Wons Capital Increase without consideration)

일반 기업 vs. 벤처 기업 vs. 성장형

벤처 기업 [기술성장기업, 기술특례상장] (자본금 10억원 이상, 매출액 30억원 이상) vs. 우회상장

자기 자본 30억 이상 or 시가총액 90억원 이상

vs. 자기 자본 15억원 이상 or 시가총액 90억원 이상

경영 성과 요건 택 1 (이익 규모, 매출액, 기준 시가 총액 중 택일)

ROE (자기 자본 이익율) 10% 이상 vs. ROE (자기 자본 이익율) 5% 이상

당기순이익 20억 이상 vs. 당기순이익 10억 이상

매출액 100억원 이상

& 기준 시가 총액 300억 이상 vs. 최근 매출액 50억원 이상 & 기준 시가 총액 300억 이상

매출액 50억 이상 & 매출액 증가율 20% 이상 vs. 매출액 50억 이상 & 매출액 증가율 20% 이상

KOSDAQ 관리종목지정 요건

<기술성장기업(기술특례상장)의 경우는 5년간 관리종목지정 유예>

매출액 최근 년 30억원 미만 <기술특례상장

기업은 적용 면제 또는 5년간 유예>

최근 3년 사이 2차례

이상 세전손실이 자기자본의 50% 이상 발생 (사업연도(반기)말 자본잠식률 50% 이상) <기술특례상장 적용 면제 또는 5년간 유예>

자본잠식률 50% 이상

사업연도(반기)말

자기 자본 10억원 미만

반기 보고서 제출기간 경과 후 10일 내 반기 검토 (감사) 보고서 미제출 또는 검토(감사)의견 부정적, 의견거절

KOSDAQ 상장폐지 요건

자본금> 최근사업년도 사업보고서상 자본금이 전액

잠식되거나 2년 연속 자본금 50% 이상 잠식

매출> 2년 연속 50억원 미만

KONEX

코넥스 상장 후 1년이 경과된 기업은 정량

요건과 정성 요건을 충족하면 코스닥 이전 상장을 신청할 수 있다.

정량 요건> 매출액 100억원, 영업이익 실현, 시가총액 300억원 등

정성 요건> 미래 성장성, 기업 투명성 등

비상장법인의 공시 의무

발행공시: 비상장법인이 증권을 모집, 매출하는 경우 1년간 모집 금액의 합계가 10억원 이상이면 증권신고서를 10억원 미만이면 소액공모공시서류 제출해야

함.

정기공시: 비상장법인이 증권을 모집, 매출한 실적이 있거나, 주주수가

500인 이상의 외감법인은 사업보고서, 분.반기보고서를

공시할 의무

주요사항보고: 사업보고서 제출대상인 경우에는

유상증자, 합병, 중요자산양수도 등에 관한 이사회 결의시

다음날까지 금융의원회에 주요사항보고서도 제출해야 함.

자본금 10억 미만 회사 설립 및 운영

간소화 (2009년 5월 15일 상법 개정)

자본금 10억 미민 정관, 의사록 공증 면제

자본금 10억 미만의 주금 납입은 잔고증명서로

대체

자본금 10억 미만의 감사 선임 면제

자본금 10억 미만 회사 이사회 폐지

자본금 10억 미만 회사 주주총회 10일 전 소집 통지 (vs. 2주 전)

자본금 10억 미만 회사 주주총회의 간소화

상법 (비상장사) vs. 자본시장법 (상장사) (비상장사는 상법만

적용을 받으나, 상장사는 자본시장법 규율을 받음)

(개정) 상법에서는 회사의 주당 가치를 높이기

위해서 회사가 자유롭게 자사주를 취득한 뒤 이익 소각할 수 있도록 규정

자본시장법에서는 여전히 이익 소각을 위해서는 주주총회에서 정관 변경을 거치도록 규정

상법과 자본시장법에 선후관계가 없으나 특별법적 성격인 자본시장법이 우선 (2012년 기준 이후에 상법 개정 폭에 맞춰 자본시장법이 고쳐져야 개정 상법이 상장사에도 반영 가능)

한국호텔전문경영인협회 www.hotelkorea.or.kr

한국관광호텔업협회 www.hotelskorea.or.kr

르네상스서울호텔 www.renaissance-seoul.com

특1급 (객실수 495개) / 삼부토건, 2013년 가을부터 매각 논의

호텔리츠칼튼서울 www.ritzcarltonseoul.com

특1급

그랜드앰배서더서울 www.ambatel.com 특1급

그랜드힐튼호텔 www.grandhiltonseoul.com

5성급[특1급]

(객실수 396, 주차 1,000대)

호텔리베라서울 www.riviera.co.kr 특2급

롯데시티호텔마포 www.lottehotel.com/city/mapo/ko/

특2급

노보텔엠배서더강남 www.ambatel.com/gangnam

특1급

임피리얼팰리스서울 www.imperialpalace.co.kr

특1급 (객실수 405)

메이필드호텔 www.mayfield.co.kr 5성급

더리버사이드호텔 www.riversidehotel.co.kr

3성급 [특2급] / 수영장 無

노보텔엠배서더독산 https://www.ambatel.com/novotel/doksan

특2급 (객실수 230개)

스탠포드호텔 www.stanfordseoul.com 특2급 (객실수 239개)

쉐라톤서울팔레스강남 https://www.marriott.com/hotels/travel/selsi-sheraton-seoul-palace-gangnam-hotel/

특1급(5성급) (객실수 345, 주차타워) / Small Bathroom

그랜드하얏트호텔 (남산) www.hyatt.com 특1급 (객실수 615개) 일일주차 1만원 별도

몬드리안호텔 (이태원) https://www.sbe.com/hotels/brands/ 5성급 (호텔긍급업 유효등급은 아직 미발급) (객실수 296개) / 실내 & 야외수영장 / 1988년 캐피탈 호텔 -> 2020년 몬드리안 & 리모델링

노보텔엠배서더동대문호텔&레지던스 https://www.ambatel.com/novotel/dongdaemun/ko/main.do

5성급, 주차장 부족 (굿모닝시티) [주차 135대

vs. 객실 523개]

ENA 스위트 호텔 www.enahotel.co.kr 3성급, Lift 주차장, 도심 이면도로 내로 찾기 힘듬.

프레이저 플레이스 센트럴 www.fpcs.co.kr 4성급, 지하 주차장 Good, 수영장, 온돌

바닥 – 레지던스호텔 (취사, 세탁기 등… 오피스텔과 같음)

L7

홍대

바이 롯데 https://www.lottehotel.com/hongdae-l7/ko.html

4성급, 지하 주차장 별도 1박 10,000원, Small 루프탑 수영장

나인트리 프리미어 호텔 서울 판교

https://www.lottehotel.com/hongdae-l7/ko.html

4성급, 지하 주차장 자유 무료, Small 루프탑

수영장 & 붐빔, 실내 욕조, 별도 커피숍 X, 파미어스몰 연계

호텔 마리나베이 서울 아라 http://www.marinabayseoul.com

4성급, 지하 주차장 자유 무료, 수영장 but 별도 고비용, 추석 연휴는 주위가 다 썰렁, 1층 커피숍 풍경 Good but only 조식

해밀톤 호텔 www.hamilton.co.kr 3성급, 지하 주차장 무료, 옥상 수영장,

지하 대형 사우나, 이태원 소음으로 수면 문제.

오라카이 송도파크 호텔 https://songdo.orakaihotels.com

특급호텔 (객실수 275개), 주차장 매우 협소 (지하 1층 & 지하 2층인데 공간 부족),

실내 & 야외수영장이 매우 작은 편.

노보텔 앰배서더 용산 https://sdc-club.com/ko 5성급, 지하 주차장

자유 무료, 수영장 협소 (어린이 가족용), 겨울에는 26도로 설정해도 20도

유지로 매우 추움.

머큐어 앰배서더 서울 마곡 https://www.homehmc.com/ko/mercure-seoul-magok

4성급, 지하 주차장 자유 무료, 수영장 협소, 6충이 로비 & 그 이하는 일반 사무실, 지하 음식점 연휴 X.

세종호텔춘천 www.chunchonsejong.co.kr 1급 (객실수 65실 (양실51 vs. 한실14실))

영동관광호텔 www.youngdonghotel.co.kr

1급 (객실수 131실)

라마다송도호텔 www.ramada-songdo.co.kr 특2급

세종호텔서울 www.sejong.co.kr 특1급 (객실수 333) / 학교법인

세종 (세종대학교)

파라다이스호텔인천 https://www.ninetreehotels.com/nth5

특1급 (객실수 173), 2015년말 폐업, 직원수 59명 (정규직 29명 vs. 비정규직 59명)

Global Hotel

힐튼호텔 www.hilton.co.kr 미국

호텔 체인

아코르호텔 www.accorhotels.com 유럽

최대 호텔 체인

Hotel Investment

모두투어리츠 www.modetourreit.com

정주영:

통천송전소학교 졸업 <대한민국>

리카싱

(리자청): 중학교 중퇴 <싱가폴>

혼다 소이치로: 초등학교 졸업 <일본>

마츠시타 고노스케: 초등학교 4학년 중퇴 & 간사이

상공학교 중퇴 <일본>

고레카와 긴조: 초등학교 졸업 <일본>

빌 게이츠: 대학 자퇴

마크 저커버그: 대학 자퇴

래리 엘리슨: 시카고대학교 중퇴

마이클 델: 대학 1학년 자퇴

스티브 잡스: 리드대학 철학과 중퇴

박대성

(한국 수묵화): 중졸

리스사

(Lease)

투자사

(IPO, M&A, PET, Venture, CRC)

은행

(Bank)

보험

(Insurance)

보증

Global

Lease Company

Orix Group (Japan) www.orix.co.jp: 세계 최대 리스 회사, 총 자산 7조 7,000억엔 (약 109조원)

오릭스 캐피탈 코리아 www.orix.co.kr

대기업의 투자펀드

GE

Capital: GE의 주요 5개 사업부문 중 금융 업무 담당 사업부로서

기업과 소비자는 물론, 항공, 헬스케어, 운송 및 에너지 산업 분야의 각종 프로젝트에 유동성 제공.

GE Capital 항공 사업, GE Capital 부동산, GE Capital Energy 금융 사업, GE Money 등

GE

Capital 항공 사업: 1,800 대 이상의 항공기를 보유함으로써 세계 최대의 항공기 보유 회사이자 세계 75 개국 235개 항공사에 비행기를 리스함.

대형 금융기관 산하

신한캐피탈 주 리스 대상: 선박, 인쇄기, 자동차, 의료기기 등 범용성이 높은 설비

뮤추얼 펀드 (Mutual Fund) 공개적으로

많은 투자자로부터 자금을 모아 주식, 채권 등 다양한 포트폴리오에 투자하는 펀드

블랙록 (black rock): 1988년 설립(직원수 8으로 시작)된 현재 세계 최대 자산운용사 (2018년 운용 자산 6조 달러 (6,700조원)[$6 trillion])

전 세계 30여 개국에 지점 & 13,000여명의 직원

Global

기업인

미국 애플, 맥도널드, MS 등의 대주주

엘리엇과 달리 지분 확보를 통해 기업

지배구조 등 경영에 간섭하지 않는 성향

1995년

PNC와 합병 / PNC 파이낸셜 서비스 그룹 블랙록 지분 2억 4,000만 달러 (2,940억원)에 매입

1999년 뉴욕 증시 상장 (주식 시장 종가 주당 14달러)

2006년 메릴린치 Investment 인수

2009년 말 바클레이스글로벌 Investment 인수

2020년

5월 11일 PNC 파이낸셜 서비스 그룹에서

보유중인 블랙록 지분 22% 매각 추진 (블랙록 주식 시장 종가 주당 493달러)

서류상 가치 170억 달러 [20조 8,200억원]

블랙록은 역으로 PNC 파이낸셜 서비스 그룹에서 매각하는 지분 중 11억 달러 어치

매입 계획

뱅가드그룹

피델리티 인베스트먼트

캐피탈 그룹 (Capital Group)

오크트리캐피털 (Oaktree Capital Management) – 벌처 펀드 (Vulture Fund)

1995년 설립

회장

& 설립자: 하워드 막스 (가치투자) – 전 TCW 최고투자책임자, 전 Citi Corp Portfolio manager

자산규모: 1,130억 달러 (2020년 3월

기준)

직원수:

950명 (2020년 3월 기준)

사모펀드 (PET Fund, Private

Equity Fund): 세계 3대 사모펀드사 – 블랙스톤, KKR, 칼라일그롭

블랙스톤

KKR

칼라일그룹 (Carlyele Group) www.carlyle.com 세계 제3위 투자 기업

1987년 설립

칼라일 테크놀러지 벤처 펀드 아시아 (Carlyle Technology Venture Fund Asia)

홍콩 본사, 2005년 5월 설립, 4억불

운용

한국

2002년부터 8000만불 투자 진행 시작: 통신 Infra, 무선 통신, 인터넷

2022년 6월 30일 기준 3,760억

달러 (약 490조원) 규모의

자산 관리 & 향후 가용 투자 자본은 810억 달러 (약 105조원)

해지펀드 (Hedge Fund)

다양한

투자 전략을 통해 시장의 변동성에 관계없이 수익을 추구하는 펀드

주식, 채권, 파생상품 등 다양한 자산 투자 및, 공매도 등 고도의 금융 기법 활용

최소

투자 금액이 높아 주로 고액 자산가와 기관 투자자를 대상으로 함

브리지워터 어소시에이츠 (Bridgewater Associates)

폴슨앤드 컴퍼니 (Paulson & Co)

소로스 펀드 매니지먼트 (Soros Fund Management)

대체자산운용사

Brookfield

(브룩필드)

운용자산: USD 9,160억 달러 (2024년 기준)

임직원수: 1,200여명

실물자산의 소유와 운영에 120년 축적된 운영전문성

전세계 30개 이상 국가의 우량 자산에 장기간 투자

PET Korea

MBK

파트너스

www.mbkpartnerslp.com

아시아 최대 사모펀드. 2015년 9월 현재 9조원 (90억불), 2017년 17조원 (150억불)

IMM

PE www.immpe.com

한앤컴퍼니 www.hcompany.com

쌍용양회, 2020년 7조원 (60억불)

Al Waleed www.alwaleed.com.sa

2013년 기준 180억 달러 중동

최대 부호.

2017년 11월 왕자와 장관 등 500여명 호텔 구금 때 구금 생활

거액의

보석금 내고 충성 맹세 및 매월 3,000만 달러(345억원) 가량의 Stock Dividend를 사우디 정부에 내는 조건으로 석방

돈을 보고 투자하면 망하게 된다.

돈이 아닌 사람을 보고 투자해야 한다.

돈을 보고 투자하면 일순간 성공해도 결국에는 망하나,

사람을 보고 투자하면 일순간 실패해도 결국에는

재기하거나 크게 성공한다.

돈을 보고 투자하는 곳은 사채업, 기업사냥꾼, 바보 등에 해당한다.

그러나 모든 사람이 다 재산은 아니다.

사기꾼과 기생충(비비적, 돈줄, 심심풀이)과 거머리와

뒷통수와 뻐꾸기와 악어와 배신자(등칼)와 스파이와,

굳은살과 허풍자와 어중이떠중이와 일을 못하거나

어리석으면서 고집만 쎈 자는 널려 있다.

Other

Elliot

Management Corporation www.elliottmgmt.com

Elliott Associates LP와 Elliot International Limited의 2개 Fund 운용

운용철학: 누구도 법 위에 있지 않다 (No one is above the law.)

2019년 1월 기준 자산 규모 340억불

미국

뉴욕 본사 vs. 런던, 홍콩, 도쿄 지사

464명의

임직원 중 168명의 투자 전문가 고용 중

맥쿼리인프라 [호주]:

B2G Infra Fund (B2G Infra에 수십년간 투자 계약), 경쟁방지조항과 최소운영수입보장으로 수십년간 안정적인 수익

경쟁방지조항:

대표적 예로 인천국제공항고속도로와 인천대교 수익에 영향을 미치는 제3연륙교 개통으로 5% 이상의 통행량 감소시 손실 보전

최소운영수입보장(MRG): 미리 약정한 운영수익이 발생하지 않으면

정부가 운영손실의 70~90%를 메워주는 계약

2012년 기준 전 세계 27개국에 110개 이상의 인프라 자산에 투자하고 있으며, 미국 다음으로 투자를 많이 한 국가가 한국임

맥쿼리인프라 투자 포트폴리오 구성

(하남데이터센터 인수 전)

|

민자기업 |

유료도로 (14) |

1조

7,510억원 (65%) |

|

항만 (1) |

2,594억원 (10%) |

|

|

철도 (1) |

827억원 (3%) |

|

|

사회기반시설사업 (비민자사업/영속기업) |

도시가스 (3) |

5,928억원 (22%) |

|

|

|

|

|

합계 |

2조

6,859억원 (100%) |

|

맥쿼리인프라 투자 포트폴리오 구성

(하남데이터센터 인수 후, 2024년)

|

민자기업 |

유료도로 (14) |

1조

7,510억원 (65%) |

|

항만 (1) |

2,594억원 (10%) |

|

|

철도 (1) |

827억원 (3%) |

|

|

사회기반시설사업 (비민자사업/영속기업) |

도시가스 (3) |

5,928억원 (22%) |

|

디지털 (1) |

3,030억원 (10%) |

|

|

합계 |

2조

9,889억원 (100%) |

|

Global Representive

Index

S&P500: 연평균 10% excluding Dividend

버핏

유언: Vanguard Index Fund (S&P 500)에

90% 투자하고, 나머지 10%는 채권(Short-Term Bond)에

투자하라.

Berkshire vs.

S&P 500

Warren

Edward Buffett 투자조합: 12 years (1957 ~ 1968) average 31.65% (Min 10.4% vs. Max 58.8%)

Berkshire: 1965 ~ 2022 ’58 years average 19.8%

S&P 500: 1965 ~ 2022 ’58 years average 9.9%

Global 3대 연금기금

#1 일본 공적연금 GPIF (2023년 기준 운용자산 1,997조원)

#2 노르웨이 국부펀드 GPF (2023년 기준 운용자산 1,885조원)

#3 대한민국 국민연금공단 (2023년 기준 운용자산 1,000조원)

투자형태

LP로

활동

총주주수익률 (주가 시세차익 + 배당금)

1988년

~ 2020년 총주주수익률 연평균 6.27%

2019년

~ 2021년 3년간 총주주수익률 연평균 10.57%

기금규모

2013년

기금 규모 400조원 돌파로 세계 3대 기금 등극

2015년

기금 규모 500조원 돌파

(국내 어떤 대기업도 경영권 매입 가능한 규모이나 블랙록 운용 자산의 10%에 불과)

Domestic 비상장 은행 자산규모

KDB 산업은행 170조원 [2009년 기준]

-> 대기업 및 중소기업 지분 보유 회사만 426곳으로서 (2016년 기준) 실질적인

국내 최대 재벌은 산업은행이다.

해외은행 자산 규모

일본은행 (Bank of Japan, BOJ)

특이한

것은 주식시장 상장되어 있음, 실질 배당이 없으므로 주가 차액을 목적으로 투자를 해야 하나 주가 우선

정책이 아니므로 무의미

안정성과 환금성 빼고 수익성은 꽝이라고

보면 됨

2018년 기준 BOJ의 보유 국채와 주식 규모가 일본의 연간 국내총샌산(GDP)보다

더 커지는 사태가 발생함.

대부분

국채로 구성된 BOJ의 보유 순자산 규모는 553조 5,920억엔 (약 5,507조원)으로서

이 정도 자산이면 전세계에서 따라올 은행은 없다.

역할: (일본은행법이 규정한 일본은행의 역할은 크게 두가지로) (1) 물가 안정, (2) 금융 시스템 안정

1884년

7월 1일부터 일본 유일한 발권은행

1885년 은본위제 확립

주식 투자 이론의 개척자이자 대부

벤자민 그레이엄 1894. 5. 9 ~ 1976. 9. 21 <미국>

30년간 연평균 수익률 17% (20년간

연평균 수익률 21%)

가치 투자의

아버지

<대표 저서> 현명한 투자자

1940년

CFA 아이디어 제시

필립 피셔 1907. 9. 8 ~ 2004. 3. 11 <미국>

1954~1965년 연평균 수익률 29.5% vs.

50년 누적 244,800%

수익률 기록

성장주의

아버지

<대표 저서> 위대한 기업에 투자하라

앙드레 코스톨라니 (Andre Kostolany) 1906.

2. 9 ~ 1999. 9. 14 <유럽>

유럽 주식 투자의 대부이자 주식투자를

예술의 경지에 올려놓은 사람

<대표 저서> 돈, 뜨겁게 사랑하고 차갑게 다루어라

1956

~ 2000년까지 45년간 연평균 15.8% 수익률 (1980년대 전: 연평균 25% [Noly Only 주식 but 채권과 함께])

명언 1: 개 산책. 개(주가)를 데리고 산책을 나갈 때, 개가 주인(본질 가치)보다 앞서거니 뒤서거니 할 수는 있어도 주인을 떠날 수는

없다.

명언 2: 주식을 사라. 그리고 수면제를 먹고 자라. 10년 뒤에 깨어나보면 부자가 되어 있을 것이다.

명언 3: 노력으로 부자가 되는 3가지 방법이 있다.

첫째. 부자와 결혼하는 것

둘째. 유망한 사업아이템으로 사업하는 것

셋째. 투자를 하는 것. 주식은 장기적으로 항상 오르기 때문에 다른 두가지

방법에 비해 부자가 되기 쉬우니 부자가 되려면 주식 투자를 해야.

기타: 초단타매매 거래인은 증권시장의 기생충으로 경멸하면서 ‘필요악’으로 본다.

그러나

그들로 인하여 거래량이 많아지므로 시장은 시세 변동의 ndrur으로부터 안전해지며

유동성이

풍부한 시장이어야 언제든 주식을 사고 팔 수 는 거래가 될 수 있다.

자산운용사 & Family Office

조지

소로스, 퀀텀펀드: 26년간 연평균 32% 수익율 투자자에게 제공

after 수수료

1992년 영국 통화 위기시 100억 달러어치의 영국 파운드화 공매도하여 단 하루만에 10억 달러

이상 수익냄

1998년 40억불 손해.

2000년

200억불 투기 자금 운용

2011년 펀드 폐쇄 및 Family Office화

마이클

스타인하트, 스타인하트 파트너스 (Steinhardt

Partners, 헤지펀드): Block Trading의 창시자

1967년

~ 1995년 28년간 연평균 수익률 연평균 24.7% 수익률 after 수수료 20%

스탠리

드러켄밀러 (Stanley Druckenmiller), Duquesne Family

보든

칼리지 (Bowdoin College, 1794) 영문학 & 경제학

졸업 – 사립 교양대학 (Liveral Arts College)

30년간 연평균 수익률 30.4% & 한번도 손실없음 <전무후무 기록 but 주식투자자라기 보다는 주식 콜옵션 거래자로서 역시나 과거

헤지펀드 경험>

헤지펀드 (조지소로스, 퀀텀펀드) 1992년

영국 파운드화 공매도 아이디어 주동자

확신있는

핵심 투자 아이디어에만 집중투자 (vs. 분산투자는 MBA에서 가르치는 가장 멍청한 짓으로 평가함!)

2~3개의

핵심 종목에 집중

(주가가

아닌) 확신이 없어지면 손절

알 왈리드: 25년 (1990~2015) 연평균 수익률 25%

피터

린치, 피델리티 인베스트먼트의 마젤란 펀드 (피터 린치, Peter Lynch): 1977 ~ (은퇴한) 1990년까지 13년 연평균 수익률

29.2%

셀비 쿨롬 데이비스 (Shelby Cullom Davis) 가문, 셸비 쿨롬 데이비스 & 컴퍼니 (Shelby Cullom Davis &

Company) [설립부터 Family Office]

주로

보험사에 투자를 하였으며, 45년

연평균 수익률 23.2%

Invest

in high-quality insurers

Invest

in undervalued insurers

Invest

with cheap leverage

Invest

for the long-run

1947년 38살이란 늦은 나이에(?) 다른 사람의 돈을 관리한 것이 아니라, 순전히 개인 자금 일부인 5만 달러(2020년

기준 60만 달러) 투자를

시작

1994년 사망시까지 9억 달러의

부를 축적함.

관리

수수료, 성과 수수료, 기업 인수 없이 단순히 저평가된 유가

증권과 복리 효과만 이용

1988년 포브스는 재산 3.7억 달러(2020년

기준 약 10억 달러)의 재산으로 미국에서 197번째 부자로 평가

3대

째 뛰어난 투자 성과로 부를 누리고 있는 가문이 됨.

대비되는

인물이 바로 워랜버핏

버핏은 1988년 재산 22억

달러로 미국에서 10번째 부자

버핏과

데이비스는 비슷한 시기에 투자 시작하였으나 버핏은 초기부터 전문적으로 다른 투자자들의 돈을 관리하면서 수수료 수입

버핏은 1969년 파트너쉽 청산하고 버크셔에만 집중하려할 때 당시 2,500만 달러 상당 부분이 수수료 수입이었음.

윌터 슐로스 (1916. 08. 28. ~ 2012. 02. 19.),

WJS Partners: 46년간 연평균 수익률 15.7%

윌터

슐로스 (Walter J. Schloss): 벤저민 그레이엄의 제자,

고졸 학력으로 1934년 월스트리트에서 잔심부름꾼으로 일을 시작

1956년 ~ 1984년 29년간 연평균 수익률 21.3%

2003년부터는 패밀리 오피스로

전향 (더 이상 타인 자금 운용하지 않음)

템플턴

그로스 펀드 (뮤추얼 펀드): 1954 ~ (프랭클린 그룹에

매각한) 1992년까지 38년 연평균 수익률 14.5%

존

템플턴 (John Templeton): 전세계적인 분산 투자를 지향한 글로벌

뮤추얼 펀드의 개척자

VIP

자산 운용 (최준철):

2003년부터 2023년까지 연평균 수익률 13.89%

존

클리프턴 보글 (John Clifton Bogle) – 뱅가드그룹 창립자 겸 초대 CEO, Index Fund의 실질적인 창시자

제임스

사이먼스 (James H. Simons) 뛰어난 수학자이자 퀀트투자 창시자, 수학 학문 분야 기여 (양자장 이론, 끈 이론) 및

응집 물집 물리학에 큰 기여, 골초

르네상스

테크놀로지 (Renaissance Technologies) 메달리언 펀드 (Medallion Fund)

고정수수료 5% + 성과수수료 수익의 44%

1988년

~ 2018년 30년간 연평균 66.1% 수익률 & 수수료 공제 후로도 연평균 39.1% 수익률 <수익률 끝판왕>

이

기간 1,045억 달러 이상의 거래 수익 올림.

같은

기간 S&P500 수익률의 1,000배

30년간

누적 수익률 33,000배

2005년 연봉 15억 달러 (1조 4,300억원)으로 전세계 펀드매니저 중 1위

그런데

회계(?) 부정으로 70억 달러의 막대한 벌금

2005년

~ 2015년 ‘바스켓 옵션’이라는 투자 방식을 활용해 단기 매매 차익을 상대적으로 세율이 낮은 장기 수익으로 전환

2024년

5월 타계 (향년 86세)

지금은

사이먼스의 퀀트투자(계량투자)가 헤지펀드의 대세를 이루고

있음

골드만삭스

또한 컴퓨터 프로그램 매매에 치중하면서 2017년 트레이더 600명을 2명으로 줄이는 대신 프로그래머 200명을 고용함.

스티브

코헨 (Steve Cohen) SAC: 다른 대가들의 확고한 투자 방식보다는

시대에 맞추어 투자 방식을 변경하고 리스크 관리함.

1992년 ~ 2003년 11년간 연평균 30% 수익률

학창시절부터

포커를 즐겼으며 패를 전부 외워서 게임을 진행할 정도의 수적 감각 보유

SEC

대대적 조사 결과 직원들 상당수가 내부자 거래 기반 투자에 개입된 것으로 드러남 [내부자 사건]

2013년과 2014년 불법 이익 및 손실 회피 혐의로 사상 초유의 수십억 달러 벌금 및 자산 몰수 및 2018년까지 펀드, 브로커, 투자

자문 금지 받음.

폐업

후 Family Office인 Point72 신설

2020년 9월 24억 달러를 들여 뉴욕 메츠 지분의 97.2%를 인수 – 뉴욕 메츠 구단주

2021년 1월 게임스탑 주가 폭등 사건에서 심각한 숏스퀴즈로 위기를 맞은 멜빈 캐피탈에 상당한 금액을 투자하여 큰 손실을

입음.

그럼에도 2023년 포브스 선정 7월 기준

175억 달러로 부호 순위 99위

Super Ant: 대부분 국내 소형주 중 가치투자 & 연평균 50% 수익률

김봉주

박용옥

Global B2G Fund

(Global 국부 펀드)

한국투자공사 (KIC, Korea Investment Corporation, www.kic.kr)

(운용자산

1,831억 달러 [2020년 말 기준])

기획재정부와

한국은행이 보유한 외화의 일부를 위탁받아 해외에 투자

수익률

2015년 -3.0%

2016년 4.4%

2017년 16.4%

2018년 -3.7%

2019년 15.4%

2020년 13.7%

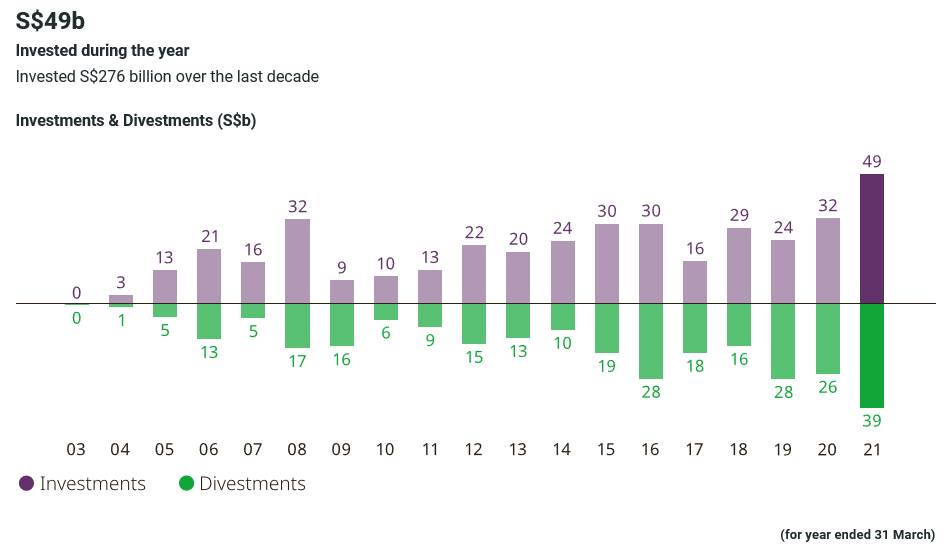

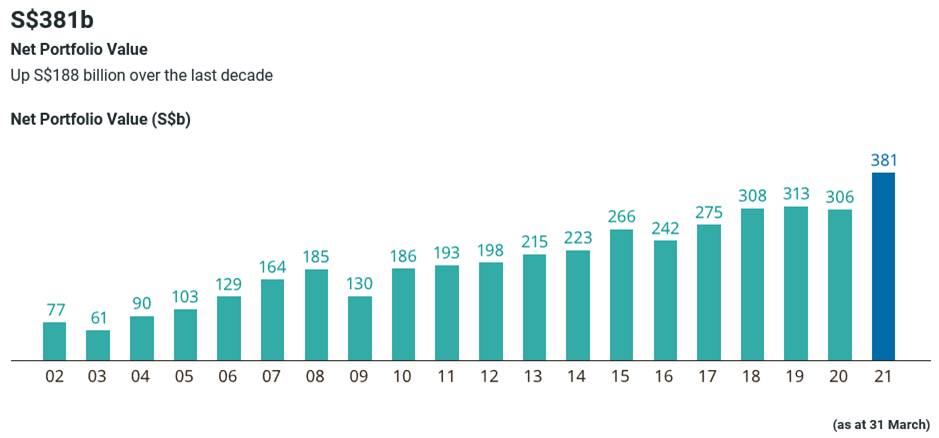

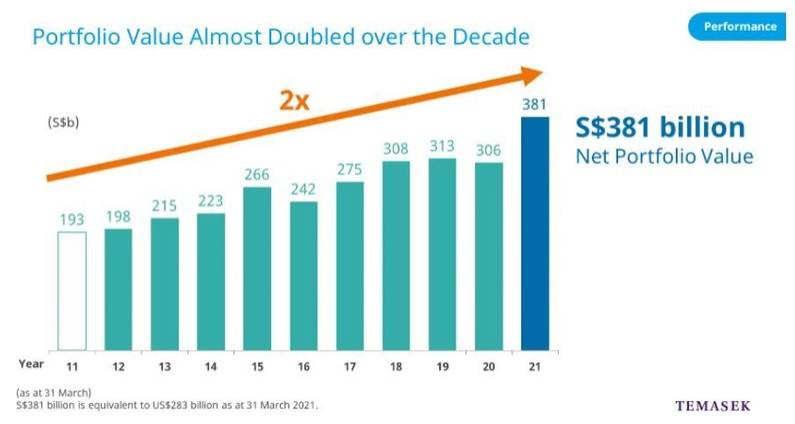

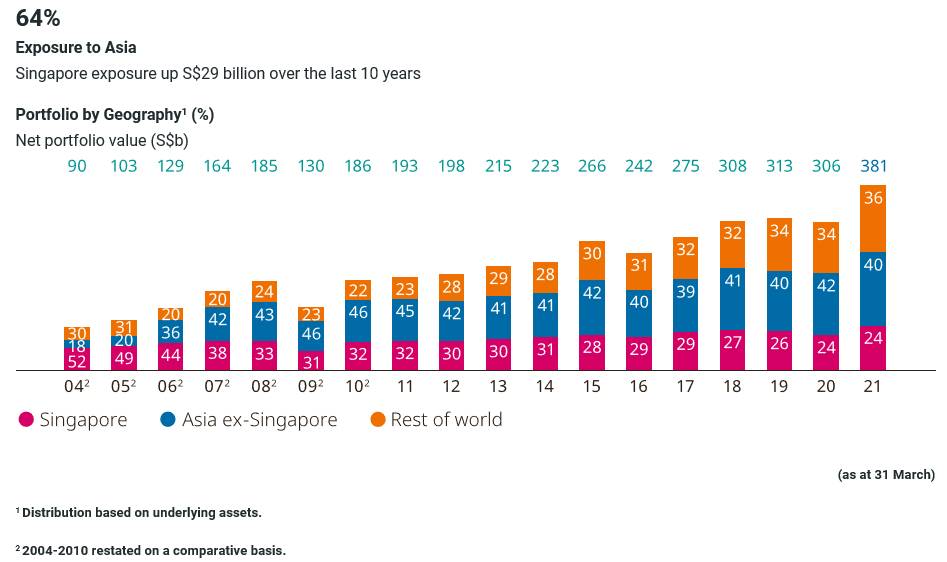

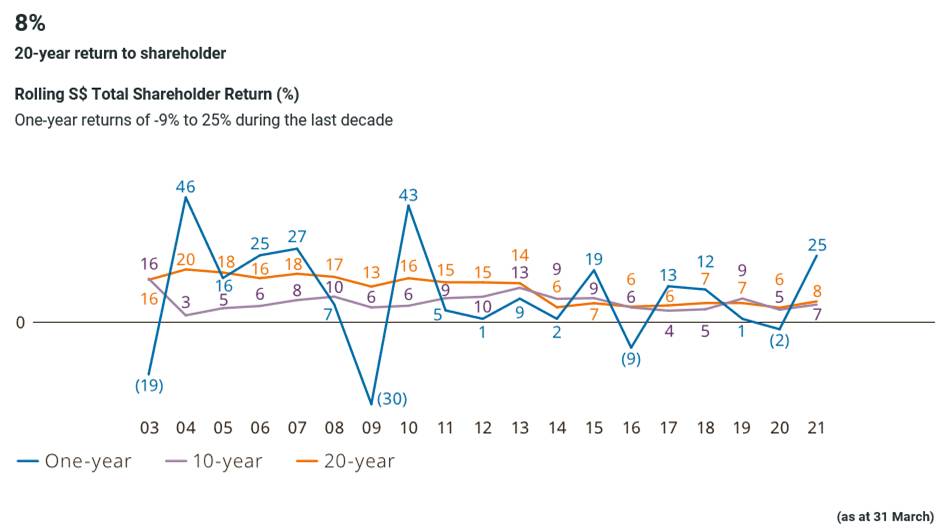

Temasek

(테마섹) [싱가폴]: 정부가 100% 지분을 보유하나, 투자 결정에 정부가 어떠한 역할이나 영향력도

행사하지 않는 원칙 & 주주인 정부에 배당금 지급

투자기준

장기적인

투자전략

혁신기업의

투자 그리고 ESG 및 탄소제로 관련 투자 등 다양한 투자

경영투명성

2004년 이후 매년 ‘테마섹 리뷰’를 발간하여

그 사업내용을 투명하게 공개

자산

1974년 출범시 자산: 3억 4,500만 싱가포르달러 (당시

환율 1억 4,160만 달러)

1983년 자산: 29억 싱가포르달러 (당시 환율

13억 7246만 달러)로 10년 만에 840% 증가

2021년 자산: 6,530억 싱가포르달러 (4,842억 달러), Global 국부 펀드 자산규모 6위

자산 Portfolio

싱가폴 25%

중국 25%

미국 20%

기타

아시아 15%

유럽 12%

호주 3%

투자형태

통상의 (대한민국 국민연금 등의) 국부펀드들은 LP로 활동을 하나, 테마섹은 주로

GP로서 공격적으로 투자 활동을 한다.

따라서

총주주수익률이 통상의 국부펀드들보다 매우 높다.

총주주수익률 (주가 시세차익 + 배당금)

1974년 설립부터 2021년: 연평균 14% <거짓이 없다면 인류 역사상 최고의

공적 기관투자자로서 엄청난 수익률 기록 중>

– (북경대

비즈니스 스쿨의 Balding 교수) 별도 자산이 재정수지

흑자 등에서 비밀리 유입 가능성과 일부러 과장된 수익률 발표 가능성

- 단, 누적 연평균 수익률이 매년 감소하는 추세이며,

특히 최근 10년 평균과 20년 평균 수익률은

10% 미만

2021년 (2020년 코로나19 다음해): 25% (미국 달러화 환산시 32%)

출처(source): www.temasek.com

대학 재단

전세계 1위: 하버드대 재단 (2015년

기준 40조원)

전세계 2위: MIT 기금 (2023년

기준 270억 달러 - 35조원)

전세계 3위: 예일대 재단 (2018년

기준 33조원) CFO 데이비스 스웬슨 <분산투자 [자산배분,

Portfolio] 대가>

1985년 ~ 2021년 기금운용수익률: 연평균 13.7% <대학 기금 운영 수익률 Global Best>

2019년 06월 기준 10년간: 연평균 11.1%

2019년 06월 기준 20년간: 연평균 11.4%

2021년 12월 31일 기준 10년간: 연평균 12.9%

2023년 기준 대학 기금 순위 Top 20

칼텍 (Caltech) 기금: 2023년 기준 36억 2,600만 달러 (4조 8,000억원)

하버드 대학교: 약 4,949억 달러 (약 660조 원)

텍사스 대학교 시스템: 약 4,497억 달러 (약 600조 원)

예일 대학교: 약 4,075억 달러 (약 540조 원)

스탠포드 대학교: 약 3,649억 달러 (약 480조 원)

프린스턴 대학교: 약 3,406억 달러 (약 450조 원)

매사추세츠 공과대학교 (MIT): 약

2,345억 달러 (약 310조 원)

펜실베이니아 대학교: 약 2,096억 달러 (약 280조 원)

텍사스 A&M 대학교 시스템: 약

1,928억 달러 (약 260조 원)

미시간 대학교: 약 1,787억 달러 (약 240조 원)

캘리포니아 대학교 시스템: 약 1,769억 달러 (약 240조 원)

노트르담 대학교: 약 1,662억 달러 (약 220조 원)

노스웨스턴 대학교: 약 1,370억 달러 (약 180조 원)

컬럼비아 대학교: 약 1,364억 달러 (약 180조 원)

듀크 대학교: 약 1,324억 달러 (약 170조 원)

워싱턴 대학교: 약 1,147억 달러 (약 150조 원)

존스 홉킨스 대학교: 약 1,053억 달러 (약 140조 원)

에모리 대학교: 약 1,024억 달러 (약 130조 원)

코넬 대학교: 약 1,003억 달러 (약 130조 원)

시카고 대학교: 약 1,000억 달러 (약 130조 원)

버지니아 대학교: 약 9,700억 달러 (약 120조 원)

공익 재단

노벨

재단 www.nobelprize.org

1895년 3,100만 크로나 기부로 설립 (약 46억 5,000만원) ~ 2024년말

기준 총자산 68억 크로나 (1조원)으로 200배 성장

투자

전략: 노벨의 ‘안전한 증권’에만 투자하라는 유언을 기반으로

시대

흐름에 맞춰서 투자 전략을 유연하게 변경

기본

방침: 벌어들인 투자 수익의 일부만 상금으로 지금하고 나머지는 재투자

투자

성과: 2024년 11.6% 수익률 (과거 10년 연평균 수익률: 8.3%)

상금은

줄어들었으나 권위는 전세계 최고의 영예

출처 (source): https://www.nobelprize.org

Big Money

2022년 기준 미국 차세대 스텔스 핵 폭격기 B-21 레이더 (B-21 Raider): 7억 9,200만 달러 (1조원)

2025년 기준 NASA 2033년 목표로 화성의 표본 회수 프로젝트 비용: 110억

달러 (15조 3,000억원)

2025년

기준 미국 벙커버스터 GBU-57 한 발당 가격: 350만

달러 (48억원)

2023년

기준 한국 155mm 포탄 수출 가격 USD 800 (100만원)

외화는 금리가 아닌 환율이 중요하다.

역으로 환리스크가 담보되지 않으면 금리가 좋아도

물어서는 안된다.

화폐와 환율도 하나의 상품이다.

은행은 ‘담보’와 ‘보증’으로 움직인다.

대표적인 담보는 금, 은, 귀금속, 땅, 건물 등 부동산 자산이며,

대표적인 보증은 국채 등 국가 기관 보증이다.

<영원한 논쟁

(endless debate)>

<워렌 버핏 버크셔해서웨이 회장> 금(Gold)은 (투자) 공포심리와 연동돼있다. 아무런 수익도 못내는 금에 투자하지 말라.

<제임스 리카즈>

종이로 만든 통화가 신뢰를 잃으면 금값은 오르며, 중앙은행 파산 가능성이 클수록 금값은

더 오른다.

Fed 등 중앙은행은 종이돈을 찍어낼 수 있는 권한을

가진 은행에 지나지 않으며 찍어낼수록 종이돈에 대한 신뢰가 흔들리며,

너무나 많은 돈을 찍어내서 돈의 양의 임계점에서는 (Fed 등의) 중앙은행은 파산한다.

특이한 것은 정작 당사자인 워렌 버핏은 현금 배당을

거의 하지 않으며 자사주 매입도 거의 하지 않는다.

한국으로 보자면 부동산을 사서 거주나 월세를 내는 것이

아니라 전세를 내는 것과 같다.

전쟁이 나도 변치 않는 자산은 땅과 금이다.

그러나 땅은 토지공개념으로 무용지물이 될 수 있으며,

금은 역으로 전쟁과 경제공항 가능성이 없을수록 무용지물이며

종이돈이 우선시다.

금 (화폐

신뢰도 반비례) vs. 은 (금과 동의 중간 속성) vs. 동 (산업재)

경기가 불안하면 금값은 폭등하며 반대로 은값은 폭락한다. (금은 대비 1:100의 격차가 더 커짐)

반대로 경기가 호황이면 은값은 폭등하며 금값은 (폭락은 하지 않아도) 안정화 된다.

(금은 대비 1:100의

격차가 줄어듬)

미래의 경기 동향(주가)은 구리값의 추이를 보면 알 수 있다.

금은 전쟁시 부도 위험이 있는 화폐나 주식과는 달리

부도 위험이 전혀 없으나 이자가 없으므로 저금리에 유리한 투자 상품이다.

금수요의 50%는

각국 중앙은행과 안전자산 투자가 차지한다. 기타로는 그저 장신구 등의 수요가 많으며 산업재는 거의 없다.

즉, 주가에

비례하는 것은 동과 은이며, 금은 주가와 반비례하나 엄밀히 말하면 화폐 신뢰도에 반비례한다.

금은 <수표나 고액권>에 대응하며, 은은 <지폐>에 대응하며, 동은

<동전>에 대응된다.

금 은 동은 부동산에 대응하여 보자면

백금 (고급주택 & 펜트하우스) vs. 금

(주택 & APT) vs. 은

(Officetel) vs. 동 (상가)

복리 이자에 따른 종이 화폐 (숫자 화폐) 증가로

경제 시스템이 붕괴되지는 않는다.

적절 인플레이션(inflation)이 뒤따르기 때문이다. 즉 기준 물가(식사값 & 집값)가 중요하다.

금은화폐의 장점은 기준 물가를 저절로 따라가기 때문이다. 즉 가지고만 있어도 복리 이자 효과가 있다.

역으로 디플레이션(deflation)이

발생할 경우 금은화폐는 가지고만 있다면 손해를 보는 것과 같다.

심지어 인플레이션은 체무자에게는 저리와 더불어 유리한

요소다. 실질 부채가 매년 감소하는 것과 같다.

역으로 디플레이션은 채무자에게 불리한 요소다.

문제는 디플레이션이 지속되면 현금을 쥐고 있으려고

하지 사용(투자)하지 않으려 한다. 결국 장기 불황이다.

적절 인플레이션 경제 하에서도 늘 소규모 디플레이션

현물은 존재한다. 대표적으로 중고차다.

반대로 집은 적절 인플레이션 경제 하에서도 그 이상의

인플레이션(거품)이 발생할 수 있다.

금은화폐는 시대와 국경을 넘어 유통되는 최종 지급 수단은 될 수 있으나

일반적인 경제 활동에 사용할 수 없는 화폐다. 어짜피 종이 화폐 (숫자 화폐)로 교환 사용되어야 한다.

금은화폐만 믿을 수 있을 정도의 경제 단계란 것은 경제 폭망 상태를 의미한다.

화폐는 신체로 보자면 혈액과 같다. 신체가 성장함에 따라 혈액량은 많아져야 한다.

반대로 신체가 노화됨에 따라 혈액량은 줄어든다.

심각한 디플레이션은 신체로 보자면 심장이 멈춘 사망상태다.

즉 적절 인플레이션이 가장 적절하나 어느 시점에

디플레이션이 오는 Cycle도 운명이다.

이자율을 보자면 인플레이션 또는 디플레이션 방향

상황을 알 수 있다.

IMF 때는 높은 이자율임에도 단기적 디플레이션 상황에

빠진 것인데 주 이유는 <외화 부족>과 <어음 제도> 때문이었다.

그러나 국제 금융도 전혀 예측하지 못하였던 hidden card가 있었는데 그것은 바로 <금모으기 운동 (225 Ton)>이다.

대한민국은 조선시대 때부터 나라 정신이 이상한 국가(집권자는 사대국 정신 & 기득권자는 벼슬과 양반 타령)로 변질되었다.

대한민국은 조선시대부터 집권자와 관료와 기득권자들이

나라를 망치고 <민초가 구하는 역사>다.

썩은 국가의 공통된 모습은 권력 위에 금권이 자리

잡고 있으면서 권력은 민초보다는 금권에 꼬리를 흔드는 상황일 때다.

안타깝게도 민초가 힘들게 구한 나라의 혜택을 민초가

받기 보다는 또다시 집권자와 관료와 기득권자들이 대부분 다시 받고 있다는 점.

결국은 민초의 정신이 깨어야 하며 그렇지 않으면

집권자와 관료와 기극권자들에게 <이용>을 당하거나

아니면 <선동>만 당하게 된다.

그러기 위해서는

<올바른 언론>이 형성되어야 한다.

그래서 국호도 대한제국(帝國)에서 대한민국(民國)으로 변경되었고, 북쪽 국호는 민주주의인민공화국. 안타깝게도 남한이나 북한이나 …

<금모으기 운동>은

임진왜란 때의 의병, 조선시대 때의 동학운동,

일제시대 때의

3.1운동, 새천년의 촛불운동과 같은 세계사적인 운동이다.

세계 어느 나라도 국가를 위하여 전국민적으로 각자의

소중한 금을 내 놓은 전례가 없다.

한국은 IMF 경험으로

어음 제도로부터의 탈피 및 외화 확보로 <현금흐름 경영>이

강해지게 되었다.

반대로 일본의 잃어버린 20년은 낮은 이자율로 장기적 디플레이션으로서 진정한 디플레이션이다.

일본 같은 경우는 은행에 예금해봐야 손해이고 갖고

있는 현금이 장땡이므로 가정용 금고 산업이 호황이 된다.

<가보지 않은 길>

2020년부터 전세계적으로 일본 뿐 아니라 유로, 영국, 한국, 미국 모든

나라들이 마이너스 금리에 진입하였다.

(중국 등 다른 나라들도 물가상승률을 고려할 때 실질적인

마이너스 금리다.)

마이너스 금리의 의미는 신체로 보자면 (경제는 신체 vs. 현금은 피)

몸은 청소년을 거쳐 중년에 이르러 더 이상 성장하지

않음에 따라

몸의 성장이 멈추어서 몸에 피의 양이 더 늘어날 필요가 없으며

심지어 반대로 피가 줄어들 필요가 있음에도 피가 공급됨을 의미한다.

또한 신체가 늙어서 피의 흐름도 예전같지 않으며 그럴

필요도 없음에도 피가 빨리 돌기를 원하는 것과 같다.

해법 중 하나는 피를 뽑아다가 피가 부족한 다른 신체(다른 나라)에 피를 공급하는 것도 하나의 방법이나 한계가 있다.

지금은 지구촌 경제가 묶여 있는 세상이다.

전세계 경제학자들이 고민해야 할 과제.

지금까지는 이자로 피를 생산하는 것에만 관심이 있었다면

앞으로는 <가보지

않은 길>로서 피를 없애는 것에도 방안을 강구해야 할 듯 (ex. 은행 이자가 아니라 은행

보관료).

큰 충격 없이 적절하게 경제 망하는 것도 하나의 방법.

왜냐하면 신체처럼 경제가 지속적으로 성장만하는 것이

아니라 멈추거나 쪼그라 들 수도 있다.

지금은 멈추거나 쪼그라드는 중년 이후의 세계 경제단계.

은행은 조혈 세포와 같으며, 투자는 혈류 분산과 같다.

노년기로 접어들어 신체의 성장이 멈추었다면 조혈세포가

그리 필요하지 않으며 혈류 분산에 집중해야 한다.

암으로 가는 혈류는 끊어야 하며, 필요한 곳의 혈류에만 집중해야 한다.

<가본 길>

금산분리: 금융자본과 산업자본의 분리 (미국 GE, …)

상투분리: 상업은행과 투자은행의 분리 (미국 2007년 국제 금융 위기,

…)

순환출자금지: 연쇄부도 (한국 IMF, …)

현금흐름경영: 어음 배척과 현금 거래, 외환과 금 (한국 IMF, …)

아웃소싱경영: 효율성

vs. 정규직 감소 및 파트타임 논쟁거리 (한국 IMF,

…)

국유화 & 민영화: 국가 Infra 기업의 경우 파산 직전 또는 경영효율성이 떨어질

경우 국유기업은 민영화로 반대로 민영기업은 국유화가 바람직

국유화: 국가 Infra 기업 (한진해운은 파산이 아닌 세금 투입하여 국유화를 했어야…), 의료국유보험 (vs. 미국의 엄청난 의료비)

민영화: 국가 infra 기업 (대한항공, 포스코, …)

은행 자본 건전성 평기 기준 (은행의 건전성

확보를 위한 자본규제)

2008년 국제금융위기 이전 전형적 평가: BIS 총자본비율 (BIS 자기자본비율) -> 은행의 위험자산 대비 자기자본비율

납입자본, 이익잉여금 등 핵심 자본으로 구성된 보통주자본비율과 신종자본증권, 후순위채

등을 더한 총자본 비율 등으로 나뉨.

그런데 신종자본증권과 5년 이상 후순위채는 회계상 자본으로 분류되는 채권으로 자기자본으로 인정되나,

정작 금융시장이 어려움에 빠지면 발행이

안될 수 있으므로 위기(Risk) 대응에 한계가 있음.

2008년 국제금융위기 이후 미국, 영국 등 주요국 금융당국 및 IMF, 국제 신용평가사 등의 Risk 평가와 관리: 보통주자본비율로 변경 추세

The 5 Biggest Private Banks (Time, Dec. 14, 1998) - Ranked by size of private bank assets. All figures estimated.

1.

UBS $580 billion

2.

Credit Suisse $290 billion

3.

Citibank $100 billion www.citibank.com

4.

Chase $100 billion

5.

Merrill Lynch (메릴린치) $100 billion

World’s

Biggest Banks (Time, Feb. 3. 2003)

1.

Mizuho Holdings (미즈호은행) $1.1 trillion. <일본> 한국 서울 지점 있음 (서울 중구 세종대로 136 서울파이낸스센터 19층)

2.

Citigroup $1.05 trillion <미국> (C)

3.

Sumitomo Mitsui (미쓰이스미모토은행) $916 billion <일본> 스미토모 은행이 주도권을

쥔채로 미쓰이와 합병하여 메가 뱅크 탄생.

4.

Deutsche Bank $815 billion <독일> 과도한 투자은행(IB) 비중에 따른 2007년 금융위기 이후 지속적인 적자 늪에서

헤어나지 못하는 상황

5.

UBS $753 billion <스위스> 스위스, 뉴욕 증권거래소에 상장 / 2005년 세계 1,000대 은행 중 1위 기업 선정됨 (The Banker) / 50개국 64,000명 직원 (스위스 37% + 유럽 16%, 미국 37%, 아시아 10%)

6.

Mitsubishi Tokyo Financial (미츠비시도쿄UFJ은행, MUFG) $741

billion <일본> 한국 서울 지점 있음 (서울 종로구 청계천로 41 영풍빌딩 4층)

7.

BNP Paribas $734 billion <프랑스>

8.

HSBC Holdings $694 billion <영국> 런던, 홍콩, 뉴욕(ADR), 파리

및 버뮤다 증권거래소에 상장 / 130개국 20만명이 HSBC 주식 보유 / 4,000만명의 고객 보유

9.

J.P.Morgan Chase & Co. $693

billion <미국> (JPM)

10.

HVB (HypoVereinsbank) Group $638

billion <독일 2위 – 이탈리아 지속적 M&A 시도 후 2005년 이탈리아 UniCredit 합병>

2019년 전세계 1,000대 은행 중 10위권 순위

(단위: 억 달러) [자료: 영국 The Banker가 전세계

4,000개 은행의 기본자본(Tier 1) 비율 수익률 등을 기준으로 선정]

순위. 은행명 <국가> 기본자본비율(Tier1)

1.

중국공상은행 중국 3,390 -> 1985년

설립되어 불과 수십년만에 중국을 넘어 세계 최대 은행으로 성장

2006년 상하이 & 홍콩 상장 및 2020년

8월 기준 시가총액 1조 7,700억 위안으로

중국 시종 2위

(중국 상장 시가총액 1위는 귀주모태 [마오타이주가 대표 상품], 시총 2조 1,700억

위안)

2.

중국건설은행 중국 2,870

3.

중국농업은행 중국 2,430

4.

중국은행 중국 2,300

5.

JP Morgan Chase 미국 2,090

6.

Bank of America 미국 1,890

7.

Wells Fargo 미국 1,680

8.

City Bank 미국 1,580

9.

HSBC 영국 1,470

10.

MUFG (Mitsubishi UFJ Financial Group, Inc.) 일본 1,460

The World’s

100 largest banks, S&P Global, 2020. 06. 07.

Canada Bank

Loyal

Bank of Canada 캐나다 왕립은행 (RY) www.rbc.com

United Kingdom of

Great Britain and Northern Ireland’s 5 Major Banks (2020)

HSBC –

2018년 기준 총자산 1조 8,900억 파운드 (한화 2,889조원), 자산

규모 기준 유럽 1위 & 전세계 7위 / 2008년 포브스 선정 세계 2,000대 기업 중 1위 차지

Barclays

– 1690년 설립,

최대주주는 카타르 국부펀드

LLOYDS

Banking Group – 1765년 설립, 2018년

기준 총자산 8,050억 파운드 (한화 1,230조원), 영국에서 가장 큰 소매 은행이자 가장 큰 보험 회사

Royal

Bank of Scotaland (RBS) – 2008년

금융위기 때 영국 정부로부터 450억파운드(69조원) 구제금융 후 정부 지분 79% (현재 62%)

Standard

Chartered

홍콩 발권 은행

HSBC: 고액권

중국은행

Standard

Chartered

Germany

도이체방크

– 독일 제1의 은행 but 투자은행(IB) 비중의 높은 상태에서 2007년 국제 금융 위기부터 적자 늪에서

헤어나지 못하는 상황

코메르츠방크 (CBKG) – 독일 제2의

은행이자 독일 제1의 민간은행

Italia

유니크레디트[유니크레딧] (UniCredit) – 2005년 독일의 ‘HVB그룹’ 인수 & 2007년 ‘캐피탈리아’를 295억 달러에 인수 및 당시

유럽 2위 은행이자 세계 5위 은행으로 등극

보유

자산 기준 세계 28위 & 점유율 기준 이탈리아에서

인테사 산파올로에 이은 2위 은행

인테사 산파올로 (Intesa Sanpaolo) –

2006년 이탈리아 2위 은행 인테사 은행과 3위

은행인 산파올로가 합병하여 이탈리아 최대 은행으로 탄생과 동시 유럽 10대 은행

취급

품목: 개인 뱅킹, 소매 금융, 저축, 퇴직 연금

2017년

이탈리아 부실은행 2개 청산시 우량자산을 인수하고, 부실자산은

국고로 넘어감

유럽 각국 대표 은행

영국 HSBC

독일 도에체방크 & 코메르츠방크

프랑스 BNP

파리바

이탈리아 유니크레디트

(UniCredit)

네덜란드 ING

Group (Internationale Nederlanden Groep) – 1743년

설립, 자산총액 1,247조원, 자본금 72조원, 매출 25조원 영업이익 11조원, 순이익 7조원 [2020]

라보뱅크

ABN

AMRO Group

스페인 VVBA

스위스 UBS

Group (Union Bank Switzerland Group)

Australia Bank

Commonwealth

Bank of Australia

ANZ

Banking Group

National

Australia Bank, Ltd.

Japan’s

Bank (2020)

4th

리소나은행 www.resona-gr.co.jp

Japan’s

5대 종합 상사

미쓰비시상사: 미쓰비시 그룹 (미쓰비시 은행,

MUFG)

미쓰이물산: 미쓰이 스미토모 은행의 미쓰이 계열

이토추상사: 미즈호 파이낸셜 그룹

스미토모상사: 미쓰이 스미토모 은행의 스미토모 계열

마루베니

Japan 3대 재벌

미쓰이 그룹 – 인간[사람]

미쓰비시 그룹 – 조직

스미토모 그룹 – 결속

Singapore

DBS www.dbs.com

귀주모태주

(Kweichow Moutai Company, Limited)

중국을 대표하는 마오타이 술을 제조하는

주류업체이자, 중국 시가총액 1위 기업

중국 경제 상황을 알고 싶으면 이 회사의

주가를 보면 된다.

[美國] 마이크로소프트 vs. [中國] 귀주모태주

China’s

Bank (2020)

5th

교통은행

6th

우정저축은행

기타: 중국초상은행 (China Merchants Bank) – 1987년 설립, 중국 최초 주식 출자 상업은행

어느나라라도 각국은 자국 돈을 얼마든지 찍어 낼 수

있다.

중요한 것은 ‘국제 결제 화폐 비중’이다.

사회주의국가에서는 위안화가 유일하다.

2019년 국제 결제 화폐 순위 (USD + Euro +

Pound + CAD = 83%)

USD 42.22%

(기축 통화)

유로화 (독,프,이) 31.69%

파운드화 6.96%

(런던은 유럽 금융 중심지이나 브렉시트 후에는 네덜란드 암스테르담으로 이동 예상)

엔화 3.46%

(예상보다 낮은데 이는 ‘엔고’ 현상의 반영도 있다.)

캐나다달러 1.98%

(실질적으로 USD와 동일 취급)

위안화 1.94%

(놀라울 정도로 인정 받지 못하고 있다. 그러나 짧은 국제무대기간을 고려한다면 매우 높은

비중이다.)

호주달러 1.55%

홍콩달러 1.46%

(아시아 금융허브 위치이나 장기적으로는 싱가포르로 이동 예상)

2019년 대한민국 결제통화별

<수출> 비중 (통관기준, 한국은행)

USD 83.5%

유로화 6.1%

엔화 3.1%

원화 2.6%

기타(위안화 포) 4.7% (위안화 1.8%)

2019년 대한민국 결제통화별

<수입> 비중 (통관기준, 한국은행)

USD 80.6%

유로화 5.9%

엔화 5.6%

원화 5.9%

기타(위안화 포) 2.0% (위안화 1.1%)

(국제 결제 화폐는 아니나) 안전자산으로

인정되는 화폐

스위스달러

싱가포르달러

2016년 각국 중앙은행 금보유량

(WGC, 세계금위원회, 2016. 1)

1. 미국 연준 8133.5t

2. 독일 3381.5t

3. IMF (국제통화기금) 2814.0t

4. 이탈리아 2451.5t

5. 프랑스 2435.5t

6. 중국 1722.5t

7. 러시아 1370.0t

8. 스위스 1040.0t

9. 일본 765.2t

10. 네덜란드 612.5t

00. 한국 104.5t

(영국 중앙은행 지하 창고에 순도 99.5% 400 트로이온스(12.5kg) 금괴 형태로 보관 중)

:

금을 인출권이란 종이 문서로 보관하는 것은 전세입자처럼 바보 같은 짓이다. 인출 거부하면 그만임.

:

심지어 영국 중앙은행 지하 창고에 보관되어 있는 금 중 상당량이 가짜 금이다.

:

단, 전쟁이 발발시 해당 금이 상대국에 넘어갈 염려가

있다면 국운이 좌우될 수 있으므로 이 경우에는 선택지 가능.

:

금은 실물로 보관해야 한다. 그러나 한국은 hidden card가 있다.

:

전국민 개인 장롱에 어마무시한 금이 분산 배치되어 있어서 국난 때 아낌없이 내 놓는 민족이다.

:

금은 세금없이 물가에 연동하여 원금 보관 목적인 것이다.

:

금은 저렴할 때 틈틈이 실물 구입해 두었다가 비쌀 때 파는 수익 목적 보다는 응급 사용 목적이다.

IMF 특별인출권 (SDR, 5년마다

바스켓 편입 재조정)

2010년

달러화 41.9%

유로화 37.4%

파운드 11.3%

엔화 9.3%

2016년

달러화 41.73%

유로화 30.39%

위안화 10.92%

파운드 8.09%

엔화 8.33%

2019년 전세계 GDP Top

20 순위 (IMF)

1위.미국-$21조 4394억 5300만(아메리카 1위)

2위.중국-$14조 1401억 6300만(아시아 1위) [2019년 1인당 GDP 1만 달러 진입 & 본토 인구도 세계 최초로 14억명 돌파]

3위.일본-$5조 1544억 7500만(아시아 2위)

4위.독일-$3조 8633억 4400만(유럽 1위)

5위.인도-$2조 9355억 7000만(아시아 3위)

6위.영국-$2조 7435억 8600만(유럽 2위)

7위.프랑스-$2조 7070억 7400만(유럽 3위)

8위.이탈리아-$1조 9886억 3600만(유럽 4위)

9위.브라질-$1조 8470억 2000만(아메리카 2위)

10위.캐나다-$1조 7309억 1400만(아메리카 3위)

11위.러시아-$1조 6378억 9200만(유럽 5위)

12위.한국-$1조 6295억 3200만(아시아 4위) [2018년 1인당 GDP 3만 달러 진입

& 2019년 1인당 GDP에서는 일본과

동일]

<참고로, 2019년 북한 GDP는 35조 6,710억원으로

추정되고 있으며 이것은 한국의 약 1/50 수준이자 대기업 하나 수준>

13위.스페인-$1조 3978억 7000만(유럽 6위)

14위.호주-$1조 3762억 5500만(오세아니아 1위)

15위.멕시코-1조 2741억 7500만(아메리카 4위)

16위.인도네시아-$1조 1117억 1300만(아시아 5위)

17위.네덜란드-$9023억 5500만(유럽 7위)

18위.사우디아라비아-$7792억 8900만(아시아 6위)

19위.터키-$7437억 0800만(유럽 8위)

20위.스위스-$7153억 6000만(유럽 9위)

기타.싱가폴-$3,628억 (고액권 발행국: 1만 싱가폴 달러[약 800만원], 1천 싱가폴 달러)

Bank of Japan (일본은행): 발권은행인

중앙은행이나 상장기업 (일반 증권이 아니라 출자증권이라는

특별한 증권이 상장됨)

정부가 55% 출자함 (자본금 1억엔)

선진국에서 중앙은행이 상장되어 있는 곳은 일본과 스위스 2곳

일본은행

주가는 일본 정부의 재정신용을 알 수 있는 지표

스위스 중앙 은행은 약소하나마 배당을 주나 일본 중앙 은행은 주가도 게속 하락하면서

배당도 아예 없다.

Schweizerische

Nationalbank (스위스국립은행, SNB): 발권은행인 중앙은행이나 상장기업

직원수:

800명

2017년 기준 보유 자산: 8,000억 달러

손실&수익: 2015년 230억

프랑 손실, 2016년 245억 프랑 수익, 2017년 사상 최대 수익인 540억프랑 (USD 550억 달러, 스위스

GDP의 8%, 애플 + JP Morgan + 버크셔

해서웨이 3기업 수익)

연방정부는

지분을 전혀 갖고 있지 않음

주요지분(52%)을 각 지방정부 및 지방정부은행들이 나눠서 갖고 있음

나머지 48%는 개인투자자들이며 독일 헨켈과 머크 등의 이사를 맡고 있는 기업인 테오 지게르트가 개인으로서는 최대 지분 6.7% 보유

1921년 법률 제정으로 이 은행 주식 1주당 최고 15스위스파랑(약 17,500원)까지만 배당금이 지급 가능하도록 하여 비 주주친화적

운영.

주가가

1,500 스위스프랑 정도면 배당률이 1% 정도에 해당

따라서 이 기업은 배당보다는 주가 차액을

기대해야 함.

기타 상장되어 거래되는 중앙은행 국가들

그리스

벨기에

한국은행:

무자본특수법인으로서 자본금이나 주식 등과 전혀 관계가 없음.

B2C(민간과

거래)를 하지 않으며, 오로지 B2G(발권은행이자 정부의 은행)와

B2B(은행의 은행)만 수행함

최고

목표: “물가안정”

by 발권은행으로서의 통화 정책 수립 및 집행

중국인민은행 (People’s Bank of China): 중국의 중앙은행, 2010년 현재 단일금융기관으로는 역사상 가장 많은 2조 4,500억 달러의 금융자산을 보유.

국영

중앙발권은행이나, 세계 각국의 통상의 중앙은행과는 달리 발권과 통화 조정 업무 외에 일반은행의 업무까지도

담당하며 업무 범위가 매우 광범위 함.

(예금, 대출, 환업무, 신탁, 저축, 대리업무, 농공상금융, 서민

금융)

USA Big 4 Banking Oligopoly

JP

Morgan Chase (참고로

JP Morgan(투자은행)은 JP Morgan Chase(상업은행)와는

별개의 다른

은행임)

City

Group

Wells

Fargo

Bank

of America

Canada Big 5 Banking Oligopoly

Royal

Bank of Canada (RBC)

Toronto-Dominion

Bank (TD)

Bank

of Nova Scotia (BNS)

Bank

of Montreal (BMO)

Canadian

Imperial Bank of Commerce (CIBC)

전세계 최고의 싱크탱크 순위

평가 by Foreign Policy - 카네기 국제평화재단 출판, 2008. 12. 26

|

1. 브루킹스 연구소 2. 미국외교협회 (CFR) 3. 카네기 국제평화재단 4. 랜드연구소 5. 헤리티지재단 |

평가 by 미국 펜실베니아대 ‘싱크탱크와 시민사회 프로그램(TTCSP)’,

2013

|

1.

브루킹스 연구소 (미국)

2.

채텀하우스 (영국)

3.

카네기 국제평화재단 (미국)

4.

전략국제문제연구소 (CSIS) (미국)

5.

스톡홀름국제평화연구소 (스웨덴)

6.

브뤼켈 (벨기에)

7.

미국외교협회 (CFR)

8.

랜드연구소 (미국)

9.

국제전략문제연구소 (영국)

10.

우드로윌슨센터 (미국) 14위. KDI (한국) 77위. 자유경제원 (한국) 84위. 동아시아연구원 (한국) |

중국 최고의 싱크탱크

|

중국사회과학원 (중국) |

일본 최고의 싱크탱크

|

일본국제문제연구소 (일본) |

기타 싱크탱크

|

제네바 안보정책센터

(GCSP, 스위스, 스위스 정부의 재정 지원) |

대한민국 싱크탱크

|

KDI (한국개발연구원) 1971년 국내 최초로 설립된 대한민국 공공기관, 인력 500여명 미국 펜실베니아대 선정 글로벌 싱크탱크(미국 제외) 6위 아시아 주요국 (한국, 일본, 중국, 인도) 싱크탱크 6년 연속 1위 |

|

|

특이 싱크탱크

|

전미주택연구소(NHI, National Housing Institute, 미국) https://shelterforce.org 전미경제연구소 (NBER, 미국) |

|

|

인구수 & 교육 수준 vs. 바다 vs. 공군력

아시아 경제 4대 호랑이 국가 (한국, 대만, 싱가폴, 홍콩)의 공통점: 바다 & 해상 요지

<2020년 기준>

서울 인구수: 1,000만명 [서울 면적: 6만 ha]

인천 인구수: 300만명

경기도 인구수: 1,300만명

(수도권: 서울 + 인천 + 경기도 = 2,600만명)

지방 인구수: 2,600만명

(대한민국 전체 인구수: 수도권 + 지방 = 5,200만명) <미국의 1/6>

대한민국 면적: 1,000만 ha (세계 107위) <미국의 1/100>

남북한 합하여 1억명 확보 필요 [통일 고구려]

심지어 남북통일 후에도 통일부는 계속

남아야 한다!

명분은 남북 사회 화학적 통일이나, 실제 목표는 고구려 역사 지키기, 동아시아 평화 활동, 간도 및 만주 통일 목표의 다양한 활동,

남북한 모두 통일은 원치 않으나 원화의

준기축통화를 목표로 한다면 발권만이라도 원화로 통일을

해야 한다.

vs.

미국 인구수: 3억명 [32,676만명] (세계 3위) <2020년>: (태평양 요지 하와이 섬부터) 전세계

바다를 정복하였다.

(미국 주 개수: 50개주 + 1수도구[Washington,

D.C] = 51개주)

미국 면적: 9억 8,000만 ha (세계 3위)

vs.

인도 인구수: 13억 8,000만명 [13억 8,000만 4,385명] (세계 2위) <2020년>

인도 면적: 3억 2,872만 ha (세계 7위)

vs.

파키스탄 인구수: 2억 2,089만명 (세계 5위) <2020년>

파키스탄 면적: 7,961만 ha (세계 33위)

vs.

방글라데시 인구수: 1억 6,468만명 (세계 8위) <2020년>

방글라데시 면적: 1,476만 ha (세계 92위)

vs.

중국 인구수: 14억 4,000만명 [143,932만 3,776명] (세계 1위) <2020년>: 중국 바다는 다양한 국가의 분쟁 (미국, 일본, 대만, 한국, 베트남, 필리핀, …)

중국 면적: 9억 6,000만 ha (세계 4위)

vs.

캐나다 인구수: 3,774만명 (세계 39위) <2020년>

캐나다 면적: 9억 9,846만 ha (세계 2위)

vs.

러시아 인구수: 1억 4,593만명 (세계 9위) <2020년>

러시아 면적: 17억 982만 ha (세계 1위)

vs.

영국 인구수: 6,788만명 (세계 21위) <2020년>: 섬나라

영국 면적: 2,436만 ha (세계 78위)

vs.

독일 인구수: 8,378만명 (세계 21위) <2020년>

독일 면적: 3,575만 ha (세계 62위)

vs.

프랑스 인구수: 6,527만명 (세계 22위) <2020년>

프랑스 면적: 5,490만 ha (세계 47위)

vs.

이탈리아 인구수: 6,046만명 (세계 23위) <2020년>

이탈리아 면적: 3,013만 ha (세계 70위)

vs.

그리스 인구수: 1,042만명 (세계 86위) <2020년>

그리스 면적: 1,319만 ha (세계 95위)

vs.

일본 인구수: 1억 2,647만명 (세계 11위) <2020년>: 섬나라

일본 면적: 3,779만 ha (세계 61위)

vs.

브라질 인구수: 2억 1,255만명 (세계 6위) <2020년>

브라질 면적: 8억 5,157만 ha (세계 5위)

vs.

맥시코 인구수: 1억 2,893만명 (세계 10위) <2020년>

맥시코 면적: 1억 9,643만 ha (세계 13위)

vs.

베트남 인구수: 9,733만명 (세계 15위) <2020년>

베트남 면적: 3,312만 ha (세계 55위)

vs.

스위스 인구수: 865만명 (세계 100위) <2020년>: 바다가 없다.

스위스 면적: 413만 ha (세계 133위)

vs.

이스라엘 인구수: 865만명 (세계 99위) <2020년>

이스라엘 면적: 220만 ha (세계 150위)

vs.

싱가포르 인구수: 585만명 (세계 190위) <2020년>: 해상 교통 요지

싱가포르 면적: 7만 ha (세계 190위) [서울보다 약간 크다고 보면 됨. 서울

면적: 6만 ha]

그러나 군사력이 무지막지하다. https://blog.naver.com/liu1995/221139116450

아시아의 스위스이자 이스라엘이라고

보면 됨

국부: 리콴유 2015년 별세

vs.

대만 인구수: 2,381만명 (세계 57위) <2020년>: 섬나라

대만 면적: 359만 ha (세계 136위)

vs.

홍콩 인구수: 706만명 <2010년>: 해상 교통 요지

리카싱 2005년 영국 런던 뎃퍼드(Deptford, London) 부지

구입 및 홍콩 이주민 타운 3,500가구 건설 진행 (홍콩

인재 & 자본), 12억 6,000만 USD (1조

5,000억원)

vs.

하이난 인구수: 944만명 <2019년>: 중국의 하와이 (관광)

vs.

인도네시아 인구수: 2억 7,352만명 (세계 4위) <2020년>

인도네시아 면적: 1억 9,135만 ha (세계 14위)

vs.

나이지라아 인구수: 2억 613만명 (세계 7위) <2020년>

나이지리아 면적: 9,237만 ha (세계 30위)

vs.

몽골 인구수: 327만명 (세계 135위) <2020년>: 바다가 없다.

몽골 면적: 1억 5,641만 ha (세계 17위)

vs.

에티오피아: 바다가 없다.

발권은행:

대부분의 국가에서는 중앙은행이 화폐 발행을 독점하나, 상업은행이

발행한 화폐를 사용하기도 한다.

홍콩달러: Hongkong Monetary Authority에서 금융관리를 하며 아래

3곳에서 발권하며, 홍콩 통화청에서도 동전과 10달러

지폐를 발행함.

홍콩상하이은행 (Hong Kogn & Shanghai Banking Corporation) <영국>

스탠다드챠타드은행 (Standard Chartered Bank) <영국>

중국은행 (Bank of China, 중국

국영상업은행이자 외환거래 전문은행)

Domestic Banks 자산 규모 (2003년 3월말 기준)

1.

국민은행 219조원

[$200 billion]

2.

우리은행 107조원

[$100 billion]

3.

하나은행 89조원

4.

조흥은행

74.8조원 <2006년 신한은행과 통합>

5.

신한은행 74.4조원

6.

외환은행 61조원

<2015년 하나은행과 통합>

7.

한미은행 49조원 <2004년 미국 씨티은행으로 인수>

<KB금융지주 지배구조, 2019년 12월 31일

기준>

국민연금공단 (1대 주주) 9.62%

JP Morgan Chase

(2대 주주)

6.16%

블랙록

5.01%

얼라이언스캐피탈 3.25%

Franklin Resources 3.17%

자사주 6.81%

우리사주조합 (실질적인 3대

주주) 0.55%

<신한금융지주 지배구조, 2020년 기준, 이사회의 사외이사 10명 중 4명은

재일교포 몫>

조흥은행(1897년 2월 한성은행으로 출범하고 1943년 조흥은행으로 사명을 변형한 한국 최초의 민간 상업은행)과

(구)신한은행(1982년 7월 7일 국내

금융사상 처음으로 재일교포가 주축이 된 순수 민간자본에 의한 설립)과

2006년 4월 1일 통합하여 (현)신한은앵으로 재출범함.

이에 따라 서울대병원 내에는 초기에는

조흥은행이 내부 은행이었으나 신한은행으로 바뀜

재일교포 간친회 17.00% (5,000여명의 재일교포 개인 주주가 단결 목소리를 내므로

사실상 대주주)

국민연금공단 (형식상 1대

주주) 9.38%

블랙록

6.13%

우리사주조합 5.12%

자사주 2.93%

<하나금융지주 지배구조, 2019년 12월 31일

기준>

주주 지분 보통주

국민연금공단 9.94% 29,851,955

블랙록

4.91%

14,731,818

Franklin Resources 4.42%

13,257,916

Capital Group 4.41% 13,248,641

The Government of Singapore 2.53% 7,584,588

Norges Bank 1.73% 5,182,477

Vanguard Total International Stock

Index Fund 1.59% 4,788,557

코오롱인더스트리 1.41% 4,239,000

People’s Bank of China (중국인민은행) 1.35% 4,049,087

Eastspring

Investments 1.32%

3,963,207

Dimensional

Emerging Markets Value Fund 1.26% 3,782,071

Abu Dhabi Investment Authority 1.24% 3,732,025

Prudential Assurance Company Limited 1.09% 3,279,505

<우리금융지주 지배구조, 2020년 12월 31일

기준>

(2020년 정부보유지분 17.25% 매각을 통한 민영화 계획 중이나 이 지분과 과점 주주 8곳 29.88%로 인하여

유통 주식수 부족으로 주가 상승의 발목이

잡히며 이로 인하여 적절 주가가 형성되지 못하여 지분 매각이 힘든 역순환 함정 빠짐)

주주 지분 보통주

예금보험공사 17.25%

국민연금공단 8.82%

우리사주조합 6.39%

<이하 과점 주주 8곳 29.88%, 우리금융의 전신인 우리은행을 민영화하면서 과점주주에 지분을

매각>

IMM PE 5.96%

푸본생명 4.00%

키움증권 3.98%

한국투자증권 3.98%

동양생명 3.98%

환화생명 3.80%

미래에셋 3.66%

유신자산운용 0.52%

<이하 시장에 실질적인 유통 주식수로서

유통 주식수가 37.66%에

불과, 정부의 과점주주로의 매각에 따른 영향>

기타 주주 37.68%

<IBK 기업은행 지배구조, 의결권 있는 우선주, 2019년

12월 31일 기준>

정부가 대주주라서 경제 위기시 중소기업 지원을 위해 유상 증자를 자주하며, 경제 위기시 배담금

축소 가능성 높음

기획재정부

51.8%

산업은행

1.9%

수출입은행

1.5%

2019 빌더버그 회의 주제

1.

A Stable Strategic Order (안정된 전략적 질서)

2.

What next for Europe? (유럽의 미래?)

3.

Climate Change and Sustainability (기후 변화와 지속 가능성)

4.

China (중국)

5.

Russia (러시아)

6.

The Future of Capitalism (자본주의의 미래)

7.

Brexit (브렉시트)

8.

The Ethics of Artificial Intelligence (인공지능 윤리)

9.

The Weaponisation of Social Media (소셜미디어의 무기화)

10.The importance of

Space (우주의

중요성)

11.

Cyber Threats (사이버 위협)

Domestic 보험사

생명보험협회 www.klia.or.kr 회원사 참조

인슈프로닷컴 www.insupro.com 생명보험사 비교

사이트

삼성생명 www.samsunglife.com

대한생명 www.korealife.com 예금보험공사 49.0% + 한화계열사 30.5% + OIFS

Partners NV 17.0% + Macquaie Life LTD 3.5%

교보생명 www.kyobo.co.kr

서울보증보험 www.sgic.co.kr

예금보험공사 www.kdic.or.kr

<짐 로저스의 코로나 조언 2020. 04.>

2020년은 최악의 3중고로

약세장이 펼쳐진다.

(1) 코로나19로

가득한 경제적 손실

(2) 높은 부채 비율

(3) 지금은 낮지만 오르면 문제가 될 이자율

최악 경제 상황에서는 적은 부채를 갖고 있는 기업은 부도를 걱정할 필요가 없으며

시장 점유율이 높은 기업도 높지 않은 부채를 갖고 있으면 상대적으로 피해를

덜 받는다.

<Who is 짐 로저스, 1942. 10. 19

~>

공식홈페이지: www.jimrogers.com

1969년 조지 소로스와 함께 컨텀 펀드 설립 (조지 소로스는 동업자가 아니라 중요 직원이었다고 주장)

1970~1980년 10여년간 수익률 4,200% 기록 및 37세 투자 현역 은퇴 후 다양한 활동

116개국 15만 2,000 마일 전세계 일주로 기네스북 등제

Learn

from Corona

Isolation &

Self-Immunity

국제 신용평가사

무디스

S&P

피치

Thermo

Fisher Scientific, Inc. (NYSE: TMO)

http://corporate.thermofisher.com

Thermo Electron

Corporation is a global technology

company serving multiple markets, including the

life sciences, telecommunications, food and beverage, chemical, and oil and gas

industries, with instrumentation, information-management software, and

worldwide service for a range of applications. The company’s

products help scientists make the

discoveries that will fight disease and prolong life. They increase

the speed and quality of communications. And they provide

knowledge to ensure the quality and safety of materials used

in manufacturing, to improve industrial processes, and to protect the

environment.

Thermo

Electron is working to become an integrated, unified company with clear

market focus, technological synergy, and strong opportunities for growth. To

help meet this objective, the company

expects to distribute as a dividend to its shareholders two existing businesses

that will be spun off completely: one serving the healthcare

industry with a range of medical products for diagnosis and monitoring,

and the other supplying systems to the paper making and

recycling industries, as well as fiber-based consumer products.

Another component of the company’s reorganization includes plans

to sell additional noncore businesses. Please

check our reorganization update for an up-to-date summary of the company’s

progress.

l 1956년 설립

l 설립자: MIT 연구원이자 기계공학교수였던 George N. Hatsopoulos

-

구상: 사회에서 생기는 needs를 파악하고 이를 해결할 기술을 창조하는 기술 중심의 회사

-

첫아이디어인 열이온학(열을 전기로 전환시키는 프로세스)의 상용 기술 개발은 현실화되지 못했지만 다른 기술 혁신을 이루어 냈다.

l 2006년

Fisher Scientific과 합병하여 Thermo

Fisher Scientific, Inc.

Automatic

Machamic Watch (Internal Combustion Engine Car)

Quartz

Watch (Electric Car) Battery Problem

Electronic

Watch (Smart Car [Pseudo-Intelligent Car] / Self-driving Car, Solar

Energy Car)

Smart

Watch (Intelligent Car)

Integrated Group (Watch , Fashion,

Automobile)

Swatch

Group (Switzerland) [ETA] www.swatchgroup.com Watch – 매년 1,000만개 시계 유통, 2013 90억 4,000만 USD 매출 / 18개

산하 Brand 소유

Prestige>

브레게 / 블랑팡

/ Glashutte-Original / Tiffany / Leon Hatot / Jaquet Droz / 오메가 (Co-Axial)

고급> 론진 / 라도

(Ceramic) ETA

중급> 해밀턴 / 티쏘 /

미도 / Certina

/ Union / Pierre Balmain ETA

대중급 (Only Quartz)> 캘빈클라인 (Fashion), 스와치 (Young Fashion vs. System

51), 플릭플락 (Children)

주문형 생산 Brand> Endura

Richmont

Group (Switzerland) www.richmont.com

피아제, IWC, 까르띠에, 바세론 콘스탄틴, 예거 르쿨르트, 로저 드뷔, 파네라이, 몽블랑, ….

LVMH Group

(France)

Hublot,

Tag Heuer, Zenith, Chaumet, Bvlgari

루이비통 / 셀린, 펜디, 디올, 지방시, 겔랑, …

Citizen

Citizen

/ Prederique Constant / Bulova

Volkswagen

Group www.volkswagenag.com Automabile

GM Group www.gm.com Automabile

Single Activity (Watch, Fashion,

Automobile)

Pateck

Philip

Rolex

엠포리오 아르마니

Bvlgari

Gucci

Fusion Group

SoftBank www.softbank.com

IT (Information Revolution) - From IT Infra to

Emerging Market Investment (Mobile, Internet, Robot, and Energy)

Various Group

GE

Korea